Gratified Long Term Day Trader is a Forex robot sold on the MQL5 website. It was launched on 11th January 2022. Thus, it is a relatively new entry into the Forex market. It is compatible with multiple currency pairs and you can run it on both MT4 and MT5 trading platforms.

Scott Fredeman, the developer behind this system, is a resident of the United States. They have an official website of their own and they have been selling Forex trading systems on MQL5 for more than five years. Other EAs from this developer include Midnight Blitz, Aggressive Grid Sniper, Blazing Night Scalper, and EA Monster Multiple Strategies.

Choosing a reliable expert advisor requires careful research and analysis. You need to look into the different performance factors like features, pricing, trading strategy, trading results, user reviews, etc. Check out our best Forex robots list to know more.

Gratified Long Term Day Trader overview

On the official website, the vendor has highlighted the EA’s ability to recover losing trades. We have some recommendations from the vendor, followed by screenshots of live signals and backtests. As per our understanding, this robot does not offer anything special or unique.

This EA trades in 14 pairs, namely AUDCAD, AUDJPY, AUDNZD, AUDUSD, EURCHF, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPNZD, GBPUSD, NZDCAD, NZDUSD, and USDCAD. It can trade in all these symbols from one EUR/USD H1 chart.

Pricing

The current price of this EA is $299. Compared to other robots, it is quite affordable. If you wish to test the performance using virtual money, you can download the free demo version of the system. Unfortunately, the vendor does not offer a money-back guarantee for this system.

How it works

The EA usually has 10 or more orders open at a time. There are dynamic price movements every day for each currency pair. The EA tries to capitalize on the daily price movements for the 14 pairs. While some pairs might be performing well, others might not. You need to set the lot size after attaching the robot to an H1 chart for EUR/USD.

Trading strategy

For some symbols, the EA follows the trend while for others it takes a countertrend approach. To determine the entry points, it takes the help of the Moving Averages indicator.

Trading results

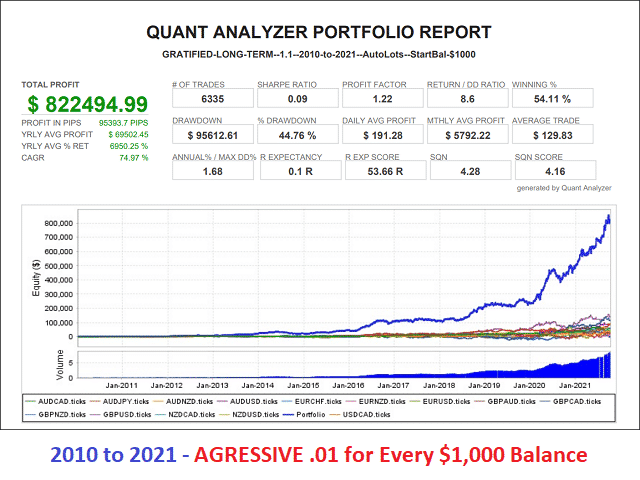

Here we have the results of a backtest conducted from 2010 to 2021. The EA conducted 6335 trades, winning 54.11% of them. The win rate is slightly lower than what we saw in the backtest. During the testing period, the EA had a profit factor of 1.22. Although the profit factor of the live monitoring account was higher, this is quite satisfactory as well.

The daily and monthly average profit for this backtest was $191.28 and $5792.22, respectively. We can tell that the robot was following a risky trading strategy since the drawdown was quite high at 44.76%. At the end of the test, the total profit was $822494.99.

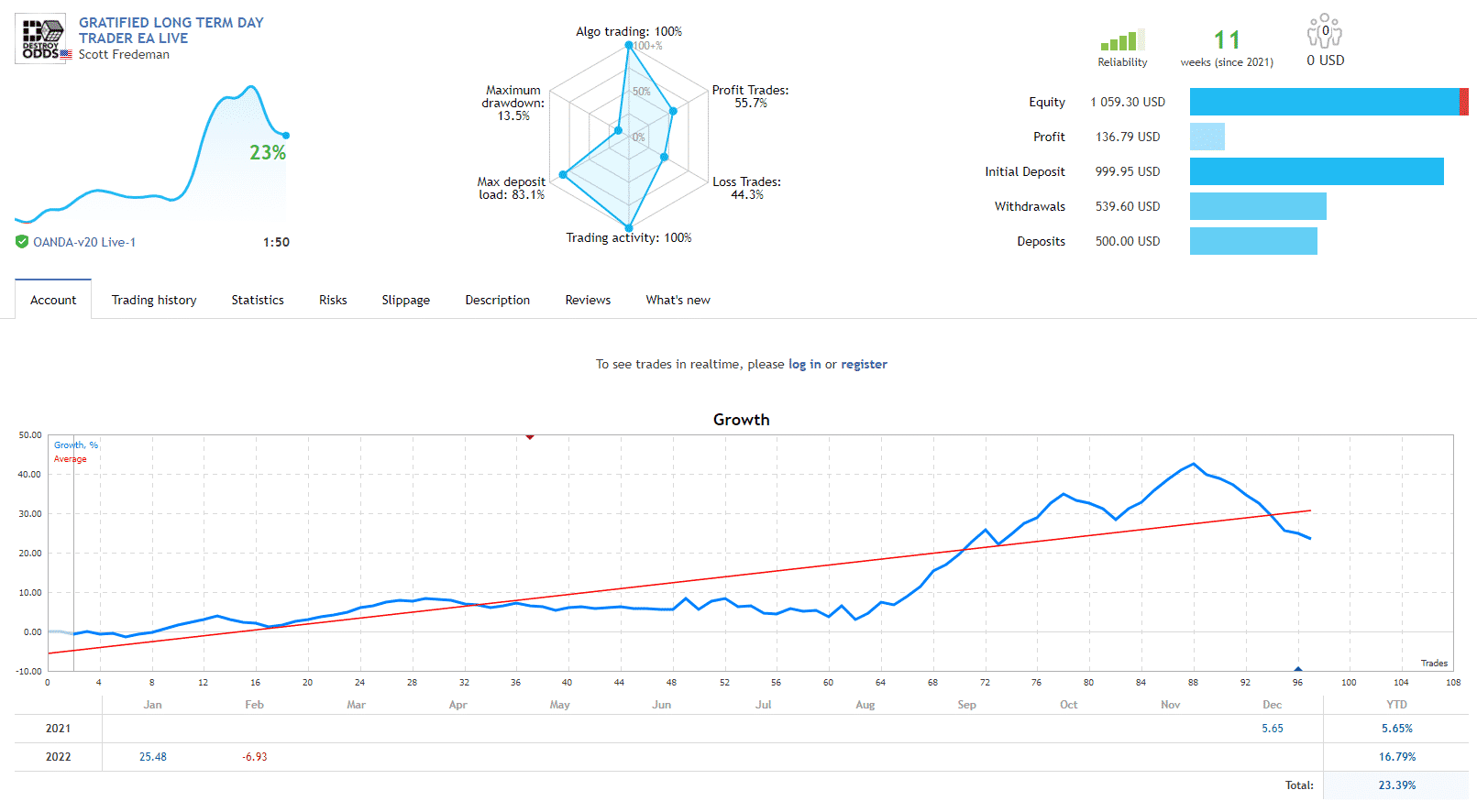

Unfortunately, the vendor has not shared the verified trading results for this expert advisor. They have shared a live monitoring account on MQL5 that was launched on December 7, 2021. To date, this account has had 37 trading days, during which it has conducted 97 trades. At this moment, it has a total profit of $136.79 and a win rate of 55.67%, which can be considered moderate.

This account has a decent profit factor of 1.42 and a total growth of 23.39%. The maximum drawdown is only 13.5%, which means the EA follows a low-risk strategy. There have been 10 maximum consecutive wins and 9 maximum consecutive losses for this account. The average profit and loss are $8.63 and $7.65, respectively.

Customer reviews

We were unable to find any user reviews for this expert advisor on websites like Myfxbook, Trustpilot, Forex Peace Army, and Quora. This tells us that this robot has a very small user base. There are a few reviews on MQL5, but we cannot consider them authentic.