DynaScalp is a scalping system that assures profitable results. The vendor claims that this completely automated system has generated more than 500% profits in a very short span with very low risk. Using the Metatrader tool can bring profits up to triple digits without any prior experience in the field.

Chris Bernell is the developer of this FX EA. The LeapFX company promotes the product. From the company info, we find that the main role of the firm is to manage Forex investments via its various services. Managed account service, automated trading tools, virtual private servers, and broker recommendation are part of the company’s services.

Dynascalp overview

On assessing the official site, we have found the following important features that the developer focuses on for this FX robot:

- The scalping software uses a new filter feature.

- It is fully automated and beginner-friendly.

- The ATS does not use the grid or the Martingale methods.

- All trades are opened and closed on the same day.

- Backtesting and verified real trading results are present.

- The FX robot works on 15 currency pairs namely AUDCAD, EURAUD, EURGBP, GBPCHF, USDCHF, AUDUSD, EURCAD, EURJPY, USDJPY, GBPUSD, XAUUSD, USDCAD, EURUSD, EURCHF, and CHFJPY.

- SL is used on all trades in addition to a smart trailing stop.

Pricing

An annual subscription package costing $247 and a lifetime membership package costing $397 is present. Features that the packages come with include the software, the best settings, free updates, the best recommendations, and customer support. A 30-day money-back guarantee is present for the packages which assure the reliability of the system. When compared to the market average, we find the pricing is affordable.

How it works

As per the developer, the FX EA does not use risky methods like Grid and Martingale. It uses strong filters for impact-creating news and closes trades before the weekend to ensure the account is protected. All settings are pre-installed and the software is set to have a high winning rate.

Trading strategy

From the info present on the official site, we find this system uses a combination of the night scalping method and management of the asset weight. The combined methods help to control the assets in a portfolio according to the existing conditions. Thus, pairs that are consistently profitable will be increasingly used while the less profitable pairs will be sparingly used.

Trading results

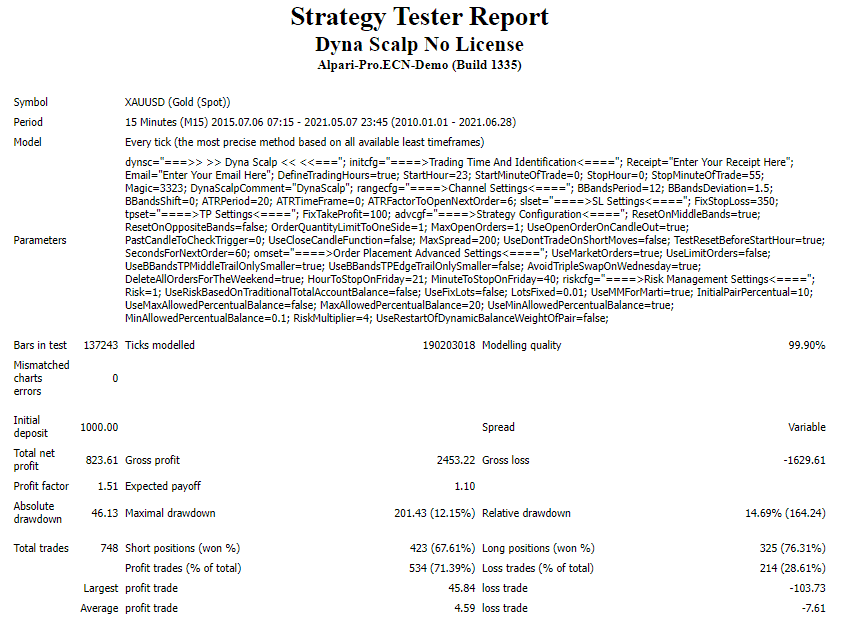

Backtesting results for different pairs are present on the official site. Here is a screenshot of the strategy tester report for the XAUUSD pair.

From the above report, we can see the testing was done from 2015 to 2021 using the M15 timeframe. For an initial deposit of $1000, the total net profit generated was 823.61. A total of 748 trades were executed with a profitability of 71.39% and a profit factor value of 1.51. A drawdown of 12.15% is present. From the results, it is clear that while the profits are not high, the drawdown is low indicating a low-risk approach.

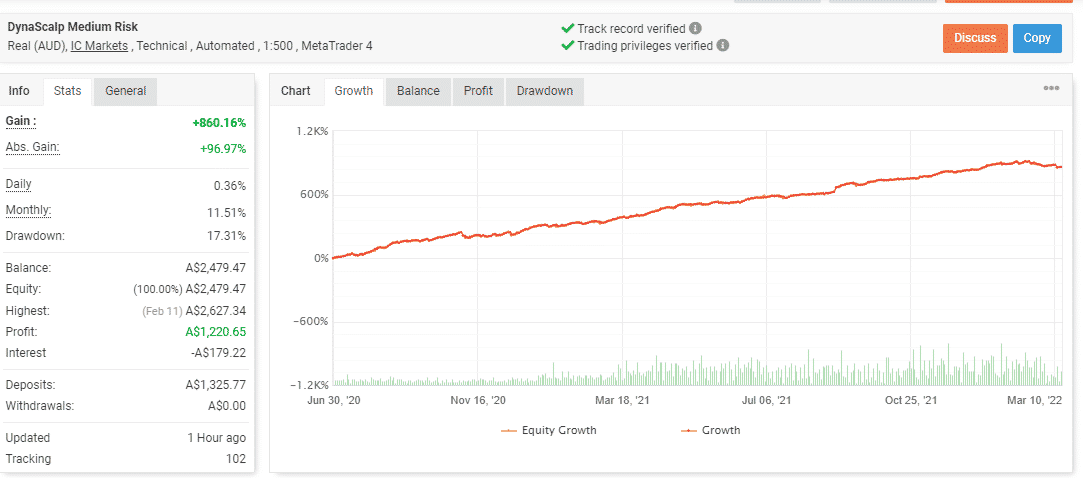

The developer also provides verified live real trading results. Here is a real AUD account using the IC Markets broker and the leverage of 1:500 on the MT4 platform.

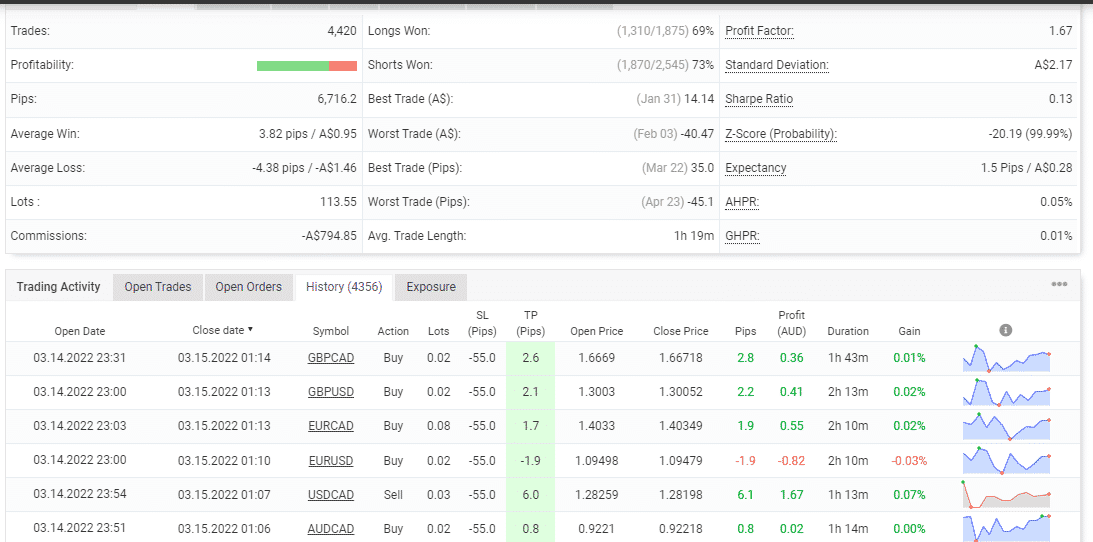

From the above stats, we can see the FX robot has generated a profit of 860.16% for an initial deposit of A$1,325.77. A daily profit of 0.36% and a monthly profit of 11.51% are present. The drawdown is 17.31%. From the growth curve, we can see a steady and upward growth indicating good performance and low risk. A total of 4,420 trades have been completed with profitability of 72% and a profit factor value of 1.67. The trading history shows lot sizes ranging from 0.01 to 0.08 have been used. While the lot sizes indicate a risky approach, the consistent growth and high profits denote the system has good risk and money management features.

Customer reviews

We found 14 reviews with a rating of 4.1/5 on the Trustpilot site for the LeapFX company. Here is a review for this FX EA:

From the above feedback, we can see that the user is satisfied with the performance of the system as it has made more than 100% profit.