Elite Tactics trading robot works on all time frames and requires an ECN broker for proper functioning. The algorithm uses a stop loss for each trade and multiple filters such as spread and slippage to save itself from a high drawdown. We will cover the system in our review to see if the system is sufficient and risk-free for our portfolio.

Elite Tactics offering

The product is available on the MQL 5 website, where all the information is available on a single page. The developer lists the features and recommendations and provides images of backtesting and live records.

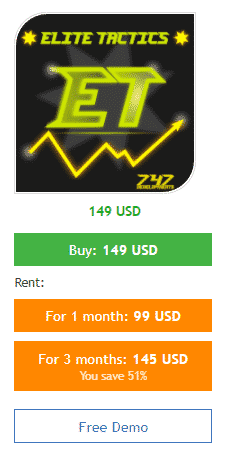

Pricing

The robot is available for an asking price of $149, and there is no money-back guarantee. Traders have the option of renting it for one month at $99 and for 3 months at $145.

How it works

The robot can be purchased from the MQL 5 website. Thereafter traders can place it in the experts’ directory of MT4 or MT5 (this version of the EA is also offered). Attach it to the charts to start trading. It is vital to enable expert advisors from the auto-trading button.

Trading strategy

The developer states that the system does not use risky strategies such as grid and martingale. It works on EURUSD at the H1 time frame and requires a minimum balance of $100. The strategy of the robot can be configured according to a trader’s liking. From the live records on Myfxbook, we can see the implementation of the scalping strategy where the average trade duration is 5 minutes. Averaging is also used on account, which falsifies the authors’ claims.

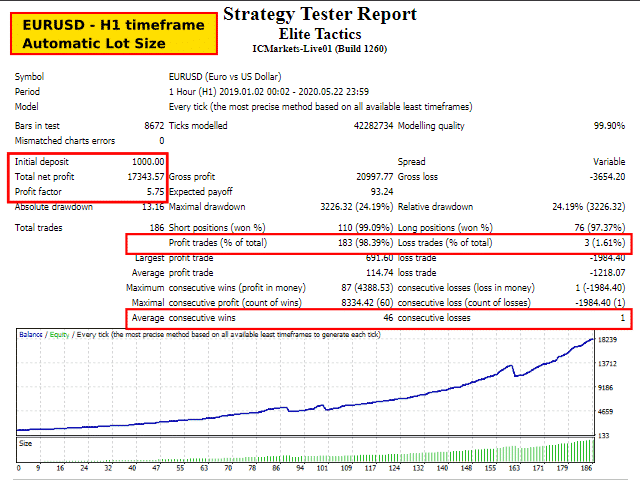

Backtesting results are available for the EURUSD. The balance drawdown was around 24.19%, and the winning rate was 98.39%, with a profit factor of about 5.75. The tests were done on the 60 minutes chart with a starting balance of $1000. The robot tanked an average profit of $17343.57 during this period in a total of 186 trades. The best trade was $691.6, while the worst one was -$1984.4. The average profitable execution was $114.74, and the loss was $-1218.07.

The stated value of drawdown is slightly high here, where the account lost nearly 25% of its trading value. This shows us that the robot can be risky while trading.

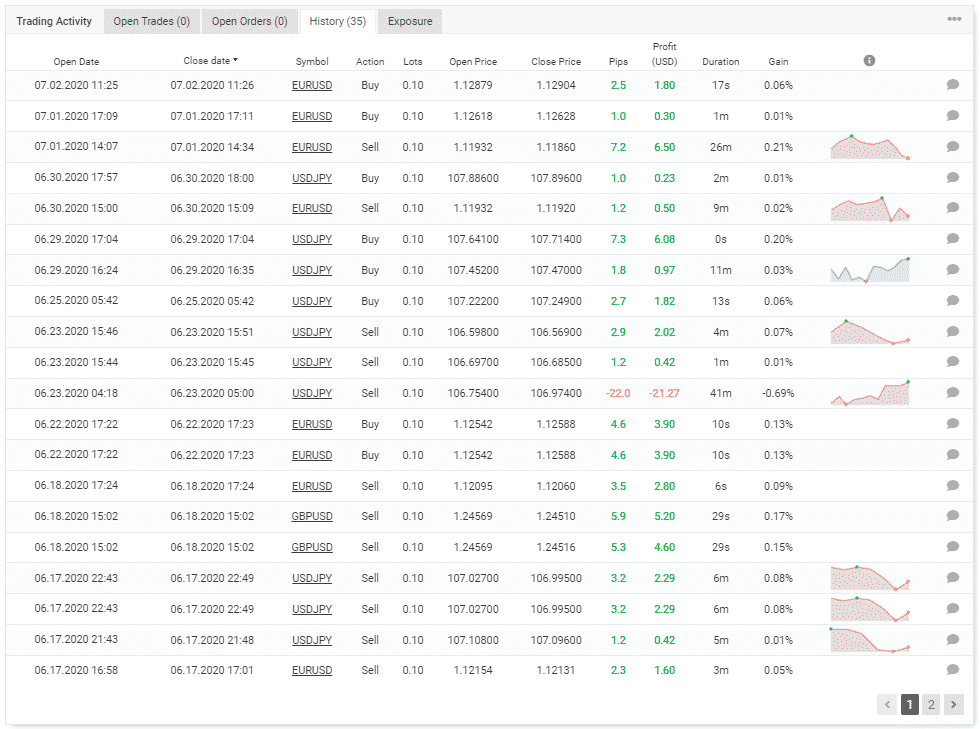

Trading results

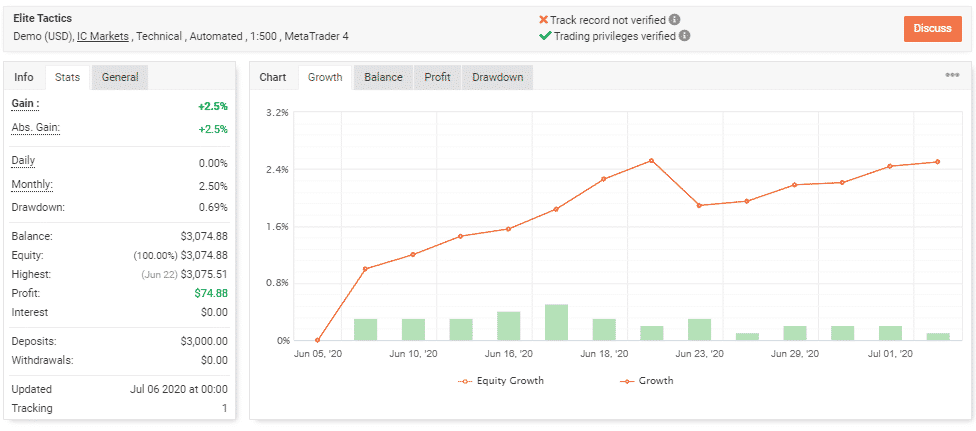

This is a live Demo account that trades on the MT4 platform automatically. The system has an average monthly gain of 2.5% with a drawdown of 0.69%.

The winning rate stood at 97%, with a profit factor of 4.52. The best trade was $14.6, while the worst was -$21.27 in a total of 235 trades.

The trading records are on a demo account which is a poor practice. Furthermore, there is no link on the MLQ 5 website to take us directly to the records. We had to search and find them out ourselves. The duration of the results is also low, which makes them useless for proper judgment.

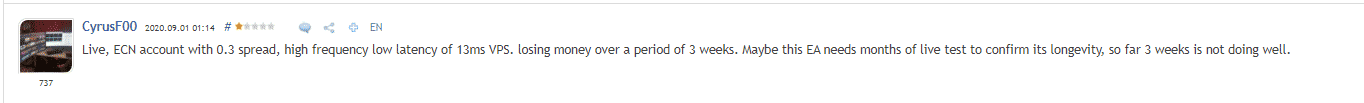

Customer reviews

There are multiple reviews present on the MQL 5 marketplace that give the algorithm a rating of 3.33 for a total of 13 feedbacks. One of the traders says that he has been testing the product for three weeks and could not find it profitable. He had satisfied all the requirements to make the robot work perfectly.