Robinhood FX EA is an expert advisor that has a pretty familiar presentation. We saw it several times for at least two years. Not only is the design familiar but also that the developers use a “CNH” account to trade. The devs informed us that it’s “One of the most profitable Forex robots.” Let’s check it out.

Robinhood FX EA features

We have united some intel in the following list to help you to understand if the system fits your expectations:

- The system is designed to execute orders automatically on a terminal.

- The advisor has a money-management system on the board.

- It doesn’t use Martingale to recover.

- The system cuts losses.

- The devs claimed that “the real trading systems don’t have such a nice equity curve. They have their drawdown and stagnation.”

- They convinced us that the best way to get started is to use the system on the demo account first.

- It generates stable profits on a monthly basis.

- There’s “Real Proper Capital Management and Specific and carefully calculated Trade Entries and exits.”

- The robot calculates lot sizes for us.

- There’s a broker spy module applied to hide SL levels from being hunted.

- The system looks for proper market conditions to open an order.

- It places correct levels of stop losses.

- It can handle various market conditions to make profits.

- There’s an automatic lot size calculation.

- We can work with any broker house.

- It supports ECN, STP, Micro, or Cent accounts.

- The system used magic numbers to mark the robot’s deals.

- We can work with default settings.

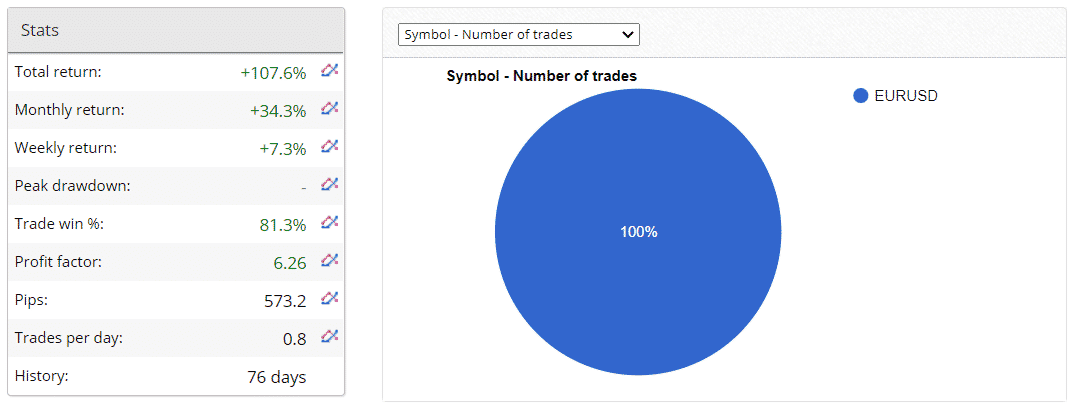

- The EA trades only EURUSD.

- The main time frame to work is H1.

- The system needs $200 for each 0.01 lot size for each pair traded.

- We may start working without any trading experience at all.

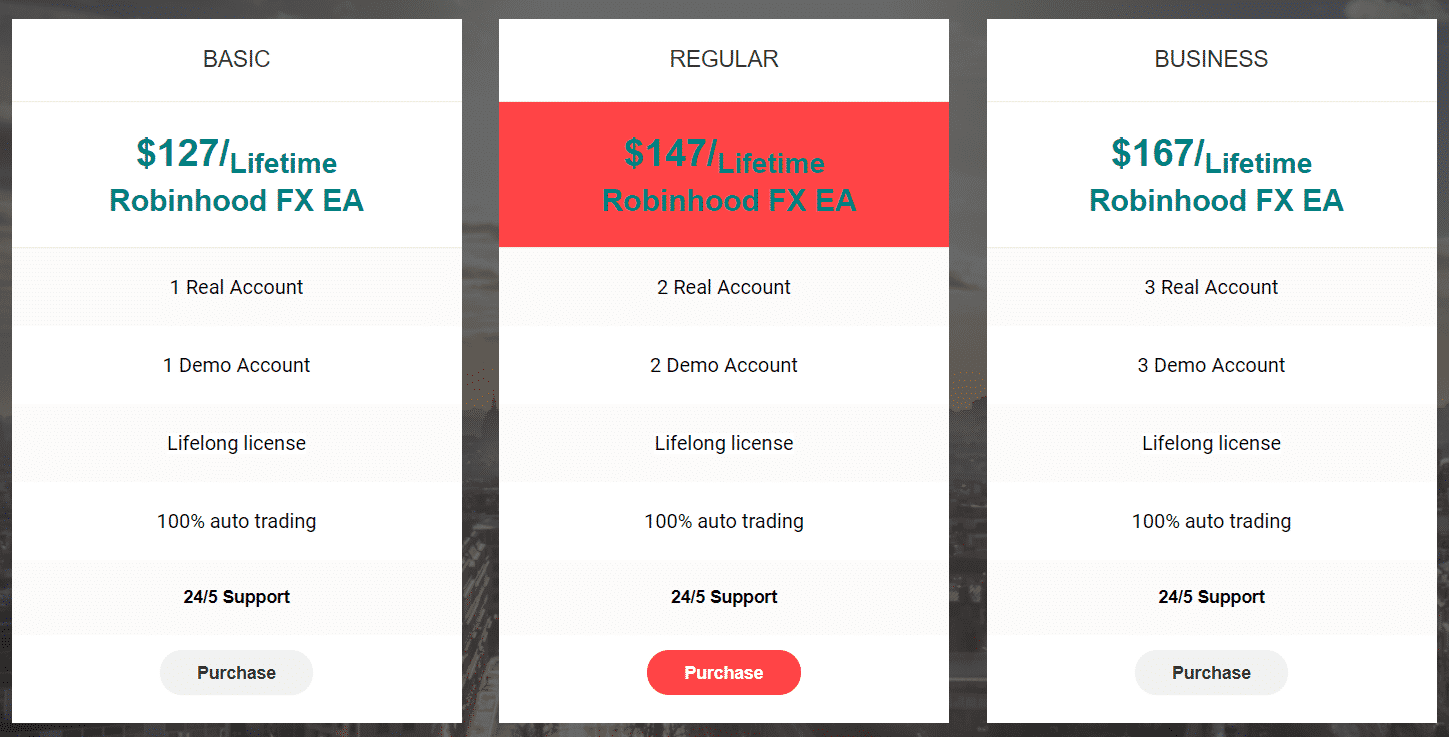

Pricing

The presentation includes three packages. The pricing is standardized. The Basic pack costs $127. We have a real account license and a demo account, with 24/5 support. The Regular pack costs $147. There are two real, and two demo accounts applied. The Business pack costs $167. There are three real and three demo accounts applied. The offer doesn’t include any kind of refund policy that could help us to get our money back if the system doesn’t work properly.

How it works

- The advisor works automatically.

- It places and closes orders on the market automatically.

- The system calculates lot sizes for us based on the available margin.

Trading strategy

- The advisor may use a Grid of orders strategy.

- EURUSD is the only pair to work with.

- It executes orders on the H1 time frame.

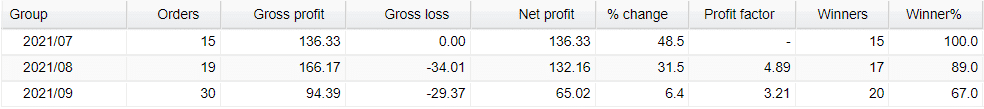

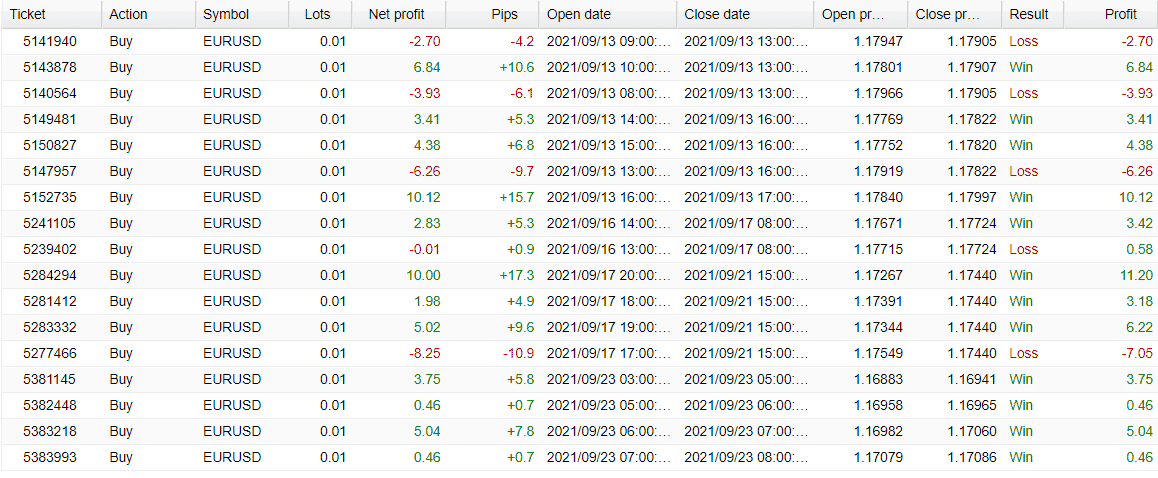

Trading results

We have no backtest reports. The robot was tested for sure, but we have no idea why the developers decided not to share them with us. It shows that there could be something to hide that shouldn’t be known, like Aggressive Martingale.

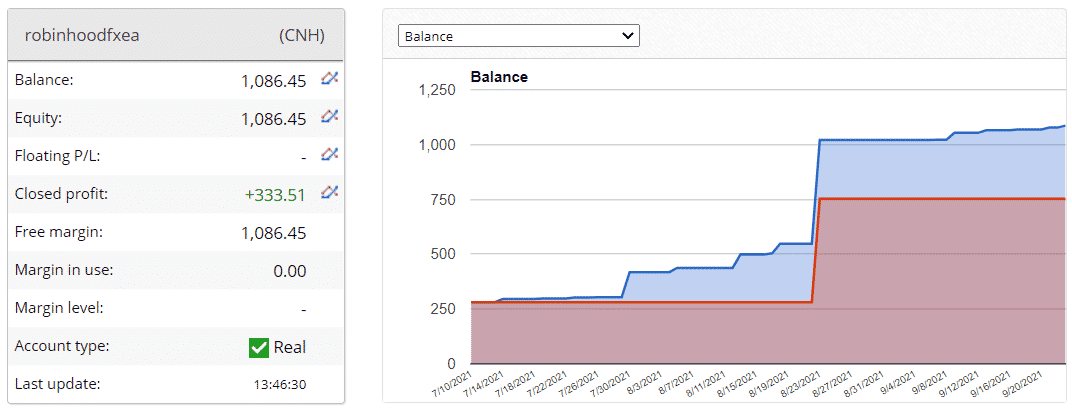

The trading results verified by FXBlue are a good sign that devs care about our expectations to see how the system works on a real account and what profits it manages to make. The advisor is applied to a real CNH account. We may note that the closed profit is $333.51. There are no orders floating on the market.

The total return is 107.6%. An average monthly gain is 34.3%. The win rate is 81.3%. The profit factor is 6.26. An average trade frequency is 0.8 deals a day. There were 573.2 pips gained. The account has been running for 76 days.

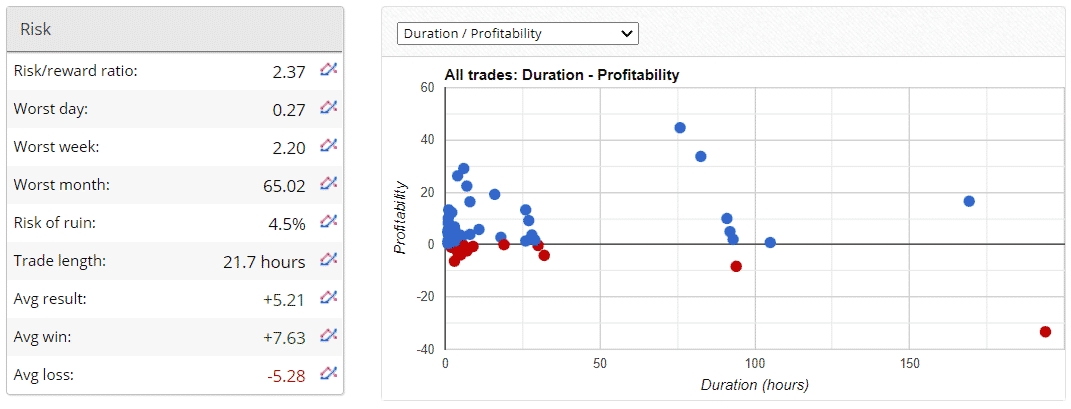

The system works with a 2.31 ROI. The risk of ruin is 4.5%. An average trade length is 21.7 hours. An average result is $5.21. An average win is $7.63 when an average loss is -$5.28.

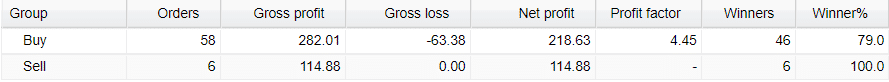

The buy direction with 58 orders is the most traded one. The system hasn’t lost any order on a sell direction.

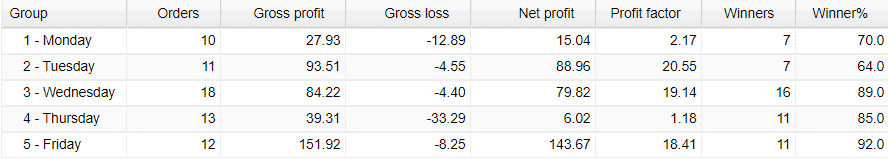

Wednesday with 18 orders is the most frequently traded day. Most of the profits were obtained on Friday - $143.67.

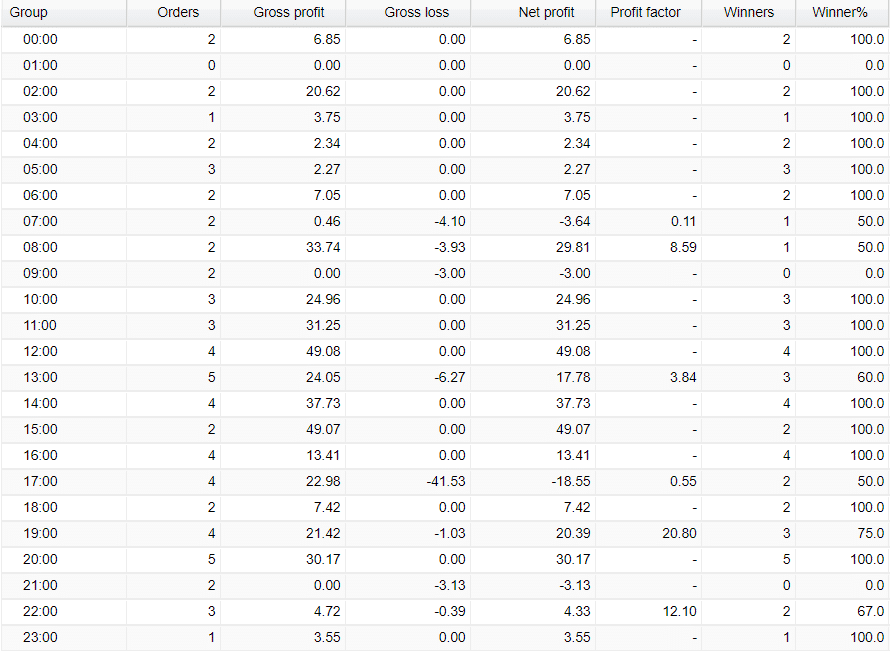

The robot works during the day equally, focusing on the European trading hour.

The advisor started trading actively in September 2021.

The system trades grids of orders to make profits.

Customer reviews

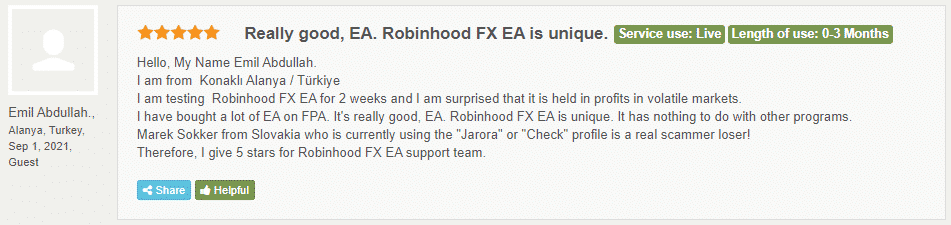

Robinhood FX EA runs a page on Forex Peace Army. We have only one comment about how the system works.

We can’t trust this faceless testimonial. It warns us that there are not many testimonials published.