FXRapid EA claims to be a highly profitable expert advisor. It is fully automated and can work on the MT4 and MT5 platforms. The trades are rapid and do not go against the trend.

We could not find info on the company like its founding year, location, phone number, etc. There is no info on the developer or the team responsible for the development of the FX robot. We could see the website domain is registered from 2020 to 2021. For support, an online contact form is present. The lack of info on the vendor makes us suspect the reliability of the ATS.

With an abundance of FX robots in the market, it is difficult to identify a reliable system. You need to look at various factors like the trading approach the system uses, its performance, features, price, support, and more. Fortunately, we have done all the hard work for you. Have a look at our best FX robots list. You will find choosing the right system for you is an easy task.

FXRapid EA overview

From our analysis of the website and the presentation of this Metatrader compatible tool, we find the vendor focuses mainly on the following factors:

- Live trading results checked by the Myfxbook site

- Backtests done on different currency pairs the EA works on

- Trend trading approach

- Broker compatibility

- Complete automation and ease of use

From the presentation, we can find that the vendor does not reveal any elaborate details of the approach, functionality, and other important aspects of the FX EA. Compared to other sites, we find the info minimal and lacking in transparency.

Pricing

To buy this FX EA, you need to choose from the two types available namely the Due and the Quattro packages. The Due package costs $269 and works on the EURUSD and the NZDUSD pairs. For the Quattro package, you need to pay $349. This package works on four currency pairs. A lifetime license, free updates, a user guide, and 24/7 support are common to both packages. A 30-day money-back guarantee is present for the product. When compared to the average price of such FX EAs in the market we find the price is expensive.

How it works

As per the vendor, the FX robot operates in such a manner that prevents protracted trades. The minimum duration of the trades is 1 to 2 days and in many cases the trades last only for around two hours. Such a working system is accomplished by avoiding a large TP and following the trend. The vendor claims that the returns are higher with this method. Furthermore, the FX robot closes the orders that have prolonged trading time.

Trading strategy

The trend approach is used by this FX EA. As per the vendor, special algorithms help in identifying the trend direction and open the trades accordingly. In the event of a rollback of price, the FX robot opens a new order in the expected direction of the trend resulting in better profits. If the trades are not with the trend, the FX robot closes the trades at a loss which it recovers after opening trades with a new trade.

Trading results

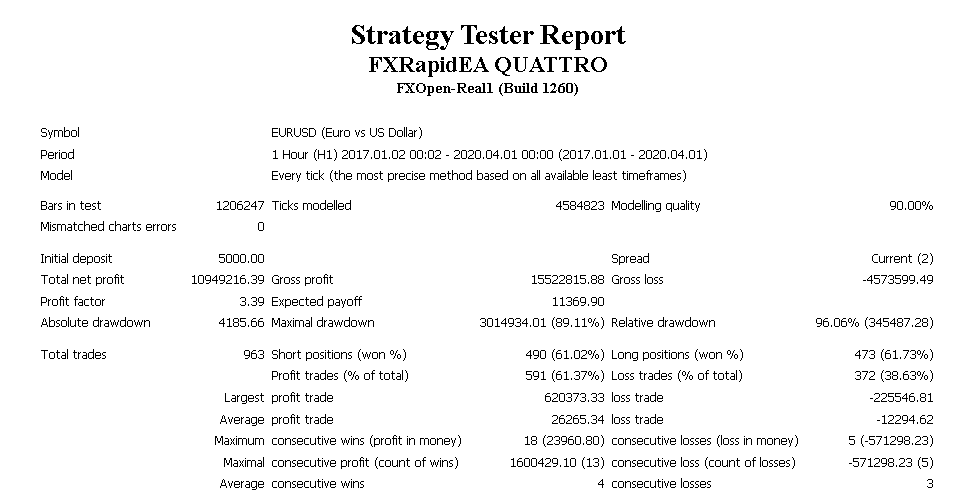

Both backtests and real trading results are given by the vendor. Here is a strategy tester report for the EURUSD pair using the H1 timeframe done from 2017 up to 2020.

A total net profit of 10949216.39 was generated for an initial deposit of $5000. The maximum drawdown for the account was 89.11% and the profit factor value was 3.39. For a total of 963 trades, the profit trades amounted 61.02%. Due to the modeling quality being 90%, we find the info provided is not sufficient to reveal important details like the commission, slippage, etc. Although the profit looks good, the high drawdown indicates the system used a dangerous approach in the past.

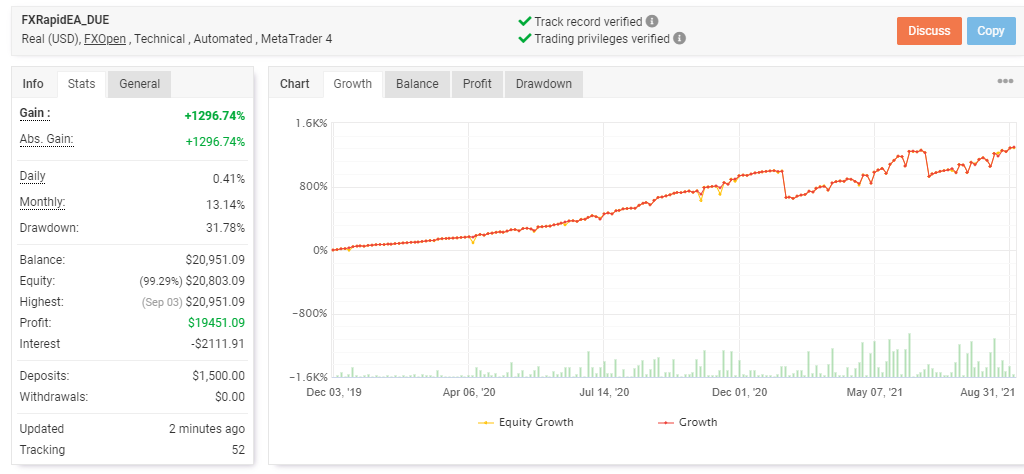

A real USD account using the FXOpen broker and the MT4 platform verified by the myfxbook site is shown here.

From the above screenshots, we can see the account has made a total profit of 1296.74% and a similar value as the absolute profit. A daily and monthly profit of 0.41% and 13.14% are present. The drawdown is 31.78%.

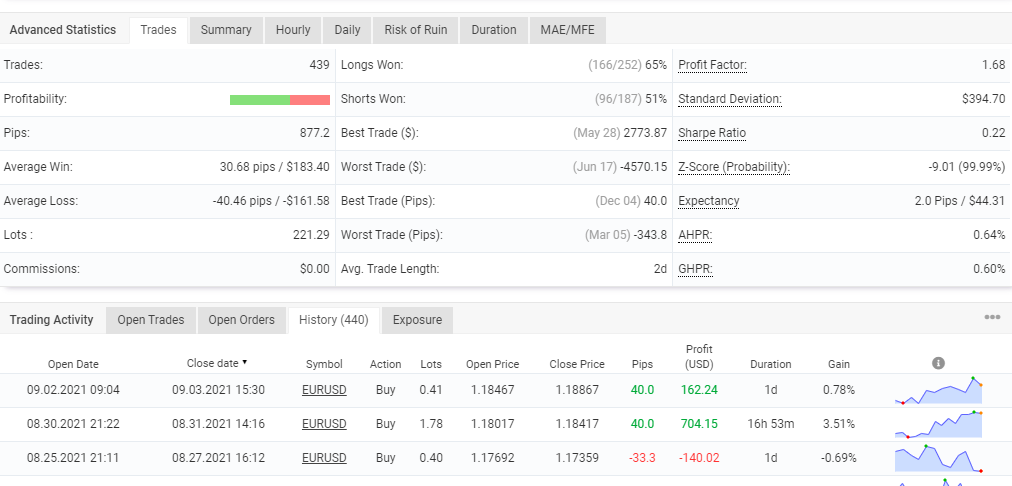

For a deposit of $1500, the account that started in December 2019 reveals 60% profitability for a total of 439 trades. The profit factor value is 1.68. We find the drawdown is very high despite the high-profit percentage. Compared to the backtesting results, the profits are not as high in the real trading denoting that the backtesting performance does not predict a similar result with real trading.

Customer reviews

We could not find feedback for this EA on reputed sites like the Forexpeacearmy, Trustpilot, etc. The lack of reviews indicates this is not a popular or effective product.