Grid Master Pro is a fully automated expert advisor that can work on both MT 4 and MT 5 platforms. The robot can also be used to trade the markets manually. As the name indicates, the algorithm uses the traditional grid strategy for trading. The company presents certain additional features such as time and news management to make the algorithm worthwhile. Let us see if the system is a good investment solution.

Grid Master Pro offering

The product is available on the company’s website, where traders can see all the features and other important highlights under a single webpage. The developer presents the live account, backtesting results, and vital characteristics of the EA separately.

Vendor transparency

FXautomater is the name of the company behind the development of Grid Master Pro. They share little to no information about themselves on the about us page. They claim that they have been trading the forex market for more than 15 years and have been developing automated systems for ten years.

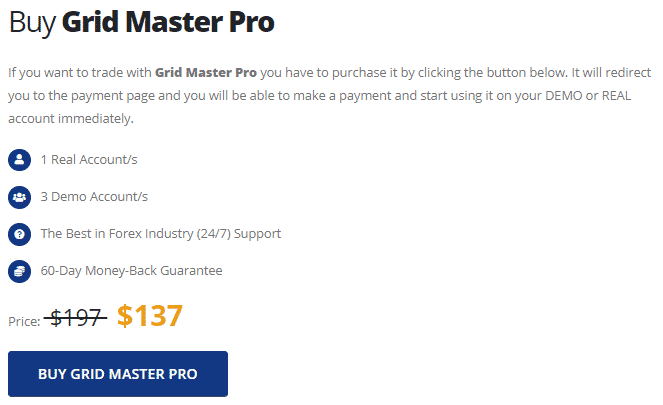

Pricing

The robot can be purchased with a one-time asking price of $137 with a 60-day money-back guarantee. It comes with a license for one demo and three live accounts.

Trading strategy

The company states that the robot trades on GBPUSD and NZDCAD. It has three inbuilt strategies which differ on the basis of recovery methodology. The robot enters the market and follows the traditional grid method in case of a losing position. When the price is in a narrow range, it will use high-frequency scalping to reduce the loss. The trades used to compensate for the risk are initiated when a market reversal pattern is detected on the charts.

On the trading history, we can see that the algorithm also employs a martingale strategy in addition to the grid. The developers do not share it, which is a poor approach.

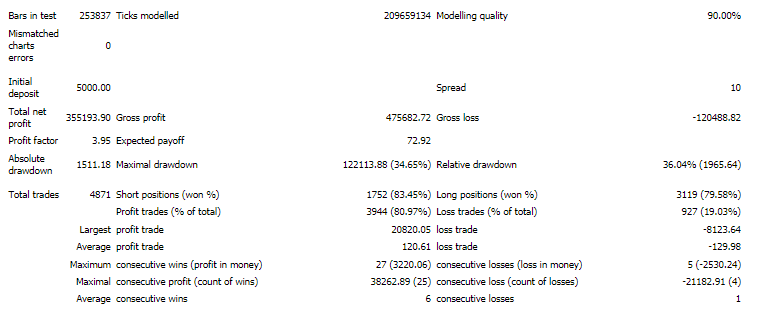

Backtesting results are available for the GBPUSD auto lot. The relative drawdown was around 36.04%. The winning rate was 80.97%, with a profit factor of about 3.95. The tests were done on the 15 minutes chart with a starting balance of $5000. The robot tanked an average profit of $355193.90 during this period. There were 4871 trades in total. The best trade was $20820.05, while the worst one was -$8123.64.

Trading results

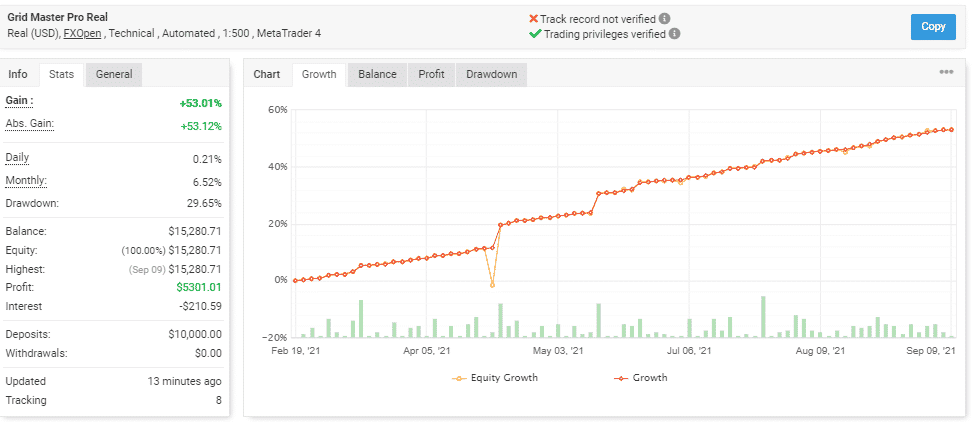

Verified trading records are available on Myfxbook that show performance from February 19, 2021, till the current date. The system made an average monthly gain of 6.52% during the period, with a drawdown of 29.65%. The stated drawdown is high in contrast with the monthly gain, which gives us a poor risk-reward ratio to follow. The winning rate stood at 73%, with a profit factor of 7.94. The best trade was $886.01, while the worst was -$59.73. There were a total of 235 trades. The developer made $10000 in deposits and $0 in withdrawals.

Customer reviews

There is a single review present on Forex Peace Army where the user states that he just started to test out the algorithm from the company. He states that he will keep on testing and provide another feedback after some time.