Hippo Trader Pro is an EA that is available in its current 2.0 version on the mql5 website. It was published there on February 25, 2021. According to the developer, the system has undergone stress tests for seventeen years and has passed each one with a very beneficial profit/drawdown ratio.

Michela Russo is the person behind this Forex robot. The only thing we know about him is that he is from Italy and has developed other trading tools like the Falcon Scalper Pro, Squirrel Trader Pro, Spider Crazy Pro and many more. We could not help but notice that all his systems are named after animals.

Anyway, we do not know anything about his qualifications or experiences in the market. So, investing in his product would be risky because it is unclear if he is an amateur or a professional developer.

Hippo Trader Pro overview

The system has the following features:

- It works on the 1 minute time frame

- Is fully automated

- It trades with the EURUSD currency pair

- Is FIFO compliant

- It can work with any broker

- The recommended minimum deposit is 3k

- Is designed to run of the MT4/5 platform

Pricing

Hippo Trader Pro is available on the mql5 marketplace at $299. The vendor also allows you to rent it for one month at $199 or for 3 months at $269. These prices are high. Furthermore, a money-back guarantee is not offered. Therefore, you may end up losing a significant amount of your money if you buy the EA and later realize that it does not perform as expected.

How it works

Hippo Trader Pro is an expert advisor. This means that it conducts trades automatically on behalf of the trader. Therefore, you will just sit back and allow it to work for you using its inbuilt strategy. The approach applied is described in the following section.

Trading strategy

This system utilizes the trend following strategy and it mostly trades during the Asian and European sessions. It particularly searches the market for the main trend. It then makes an entry based on volatility (ATR Filter) and uses some trend pattern to forecast the possible future trend. The robot also applies the relative vigor index oscillator to spot the trend.

This strategy explanation is too vague. The vendor does not say the types of patterns and trends the robot looks out for or follows. Notably, we later discovered through the live trading results that grid and martingale strategies are also being used. These are very dangerous methods.

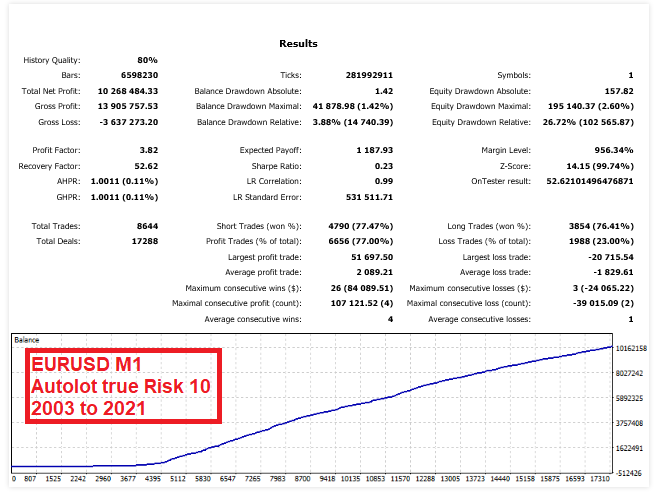

The backtest results for this system have been provided and we have analyzed them below:

The EA was backtested from 2003 to 2021 on the 1 minute time frame using the EURUSD currency pair. The trades conducted during this time period was 8644. The short positions won were 77.47% while the long ones were 76.41%. These outcomes point to a not so profitable system. The average profit trade was $2,089.21 when the average loss trade was -$1,829.61.

Apparently, the total net profit was $10, 268,484.33, which we think is unrealistic. We do not know the amount that was deposited since this data is missing. The profit factor was 3.82. The maximum drawdown of 1.42% was small.

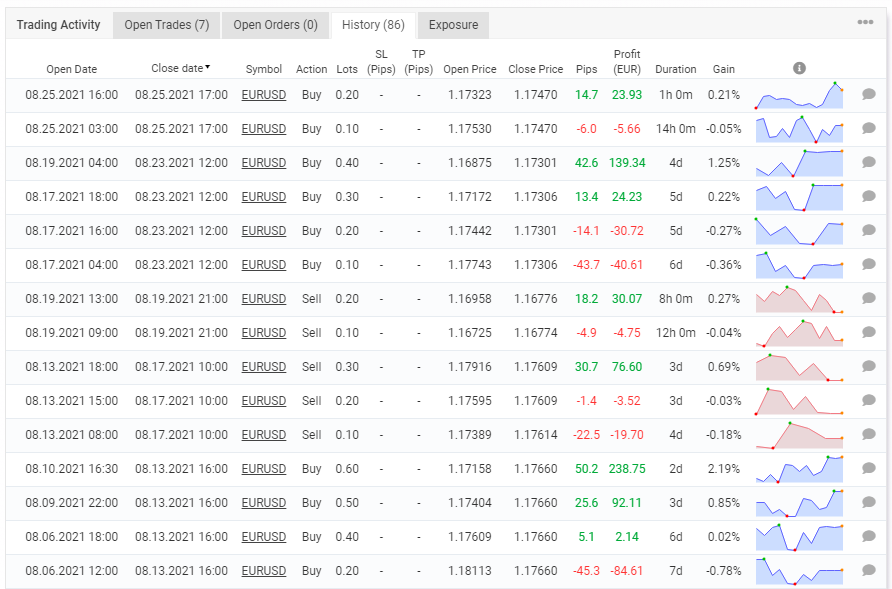

Trading results

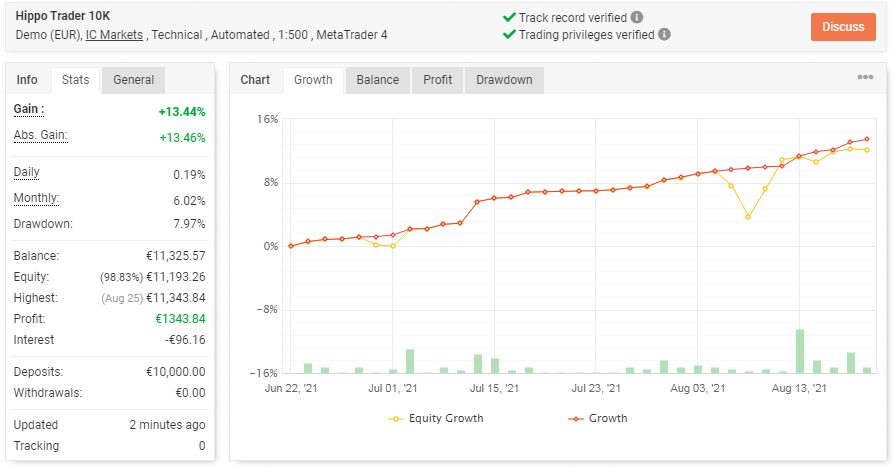

The trading statistics of the robot can be found on Myfxbook.com. Let’s have a closer look at them below:

We have been provided with a demo EUR account that is operating under IC Markets and using a leverage of 1:500. It started its operations in June 2021, and to date, it has attained a gain of 13.44%. The account was deposited at €10,000 and made a profit of €1,343.84. The balance is €11,325.57 now.

The daily and monthly profits currently stand at 0.19% and 6.02% respectively. The drawdown (7.97%) is slightly higher than the one in the backtest report. It seems that the trading strategy generates more risks in the live market.

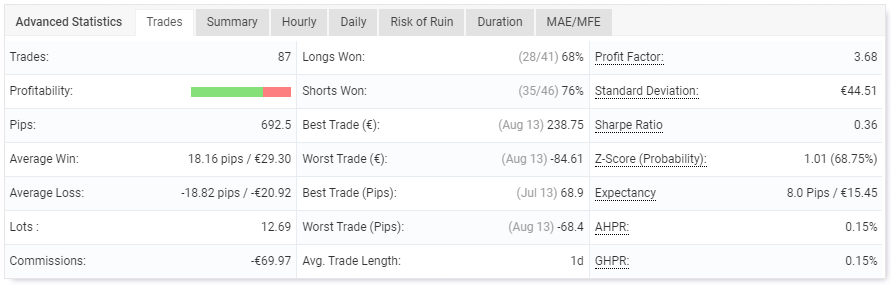

It is reported that the EA has made 87 trades with 12.69 lots. The win rate values for longs (68%) and shorts (76%) are lower than the ones we have seen in the backtest statement. Apparently, the profitability rate of the system in the live market is not that good. The profit factor is 3.68. A total of 692.5 pips have been made. The average loss of -18.82 pips is a bit higher than the average win of 18.16 pips.

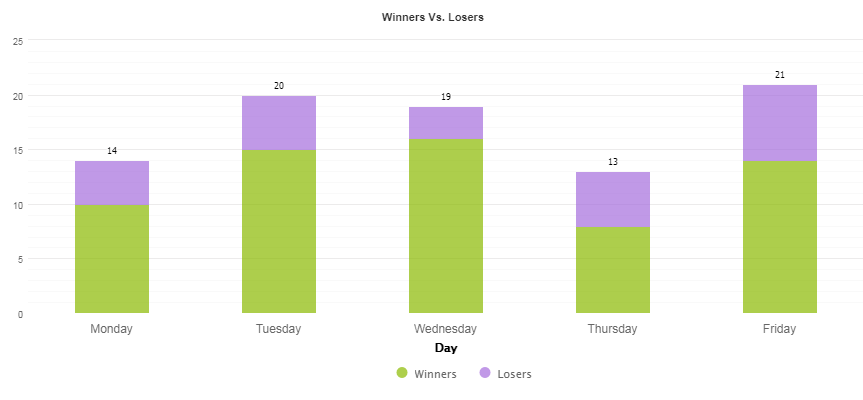

Friday had the highest number of trades-21 deals.

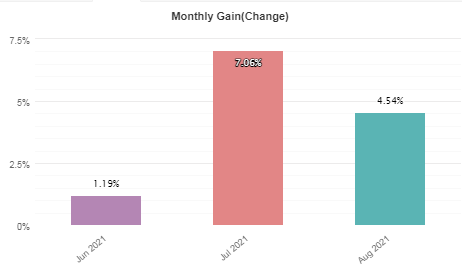

July was the most profitable month as it attained 7.06% in profits. Till now, the profits made in August are 4.54%.

Large lot sizes as well as long time frames were utilized. Grid and martingale strategies are on the board. The system doubled the lot size every time it made a loss. All this was done to try to recover the amount of money lost.

Customer reviews

All client testimonials of the robot on the mql5 site are positive. However, we cannot easily believe these reviews. The traders could have been paid to write them..

Other notes

Traders who purchase this robot are promised a free copy of another EA created by this vendor. In order to receive it, you are advised to contact the developer by mql5 message or email.