Champion EA is an expert advisor that has below average success among other advisors because of its high pricing. The presentation looks okay, so we have to figure out if the system fits our expectations.

Champion EA features

The advisor works with some details, settings, results, and other useful information explained.

- We can execute orders completely automatically, working on our trading accounts.

- Trading is allowed on five symbols. It’s not much, but it’s okay.

- There’s a drawdown reduction.

- We have a time filter to decide when it’s the right time to trade.

- We have no copies left for $488, $588, and even $588.

- The current price is $1250.

- This is an absolutely overpriced offer.

- It follows NFA and FIFO rules.

- We can get lower than 10% drawdowns.

- We don’t need previous trading experience to work well with it.

- The dev provides us with an invitation in the VIP chat.

- “The advanced INFINITY dashboard panel informs the trader about all the necessary information about the account, the ratio of profit or loss, the amount of free margin, etc. The adviser analyzes the price of each candle and its dynamic deviation in the flow of quotes and makes a decision only when the candle closes.”

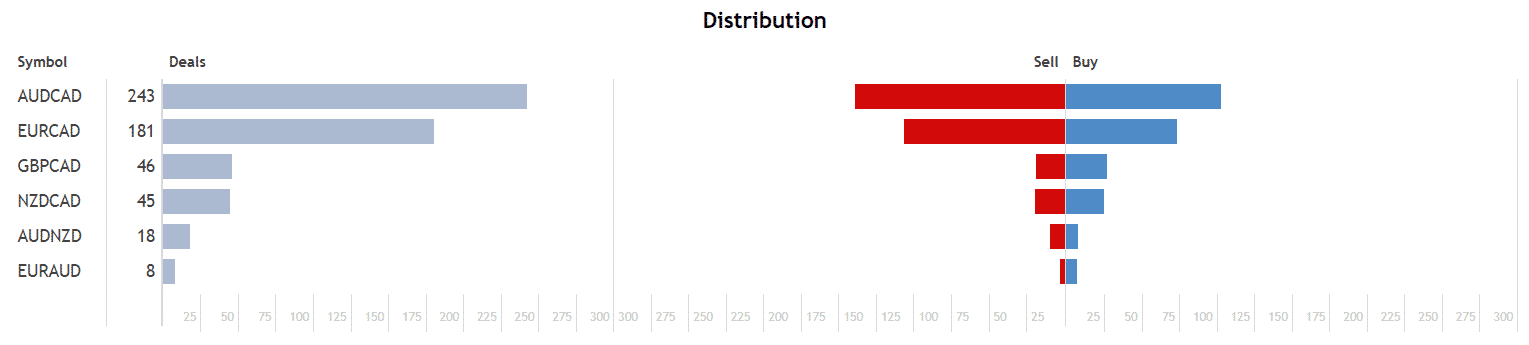

- Tradingis allowed on: AUDCAD, NZDCAD, EURCAD, GBPCAD, and AUDNZD.

- It can be used from a single chart.

- The advisor doesn’t require it to be customized.

- “It has no analogues on the market.”

- “For quick testing use the 1M OHLC, as the EA only uses open prices internally as well.”

- The Expert Advisor should be attached to only one H1 chart of AUDCAD.

- We have to trade only on recommended pairs.

- We have to use it on a Hedge account only.

- The system isn’t sensitive to spreads.

- We have to work with it on ECN and VPS.

- It opens trades not frequently.

- We can start trading from $100.

Pricing

The system can be purchased for $588. We have no rental options provided. It can be downloaded for demo usage.

How it works

- The advisor calculates entry points.

- It manages lot sizes.

- It calculates SL and TP for us.

- The presets are closed automatically.

Trading strategy

- The core strategies are trend or price action.

- Trading is allowed on AUDCAD, NZDCAD, EURCAD, GBPCAD, and AUDNZD pairs.

- The core time frame to open trades is H1.

Trading results

It’s typical for the dev not to provide backtest reports. It’s a con because we can’t check how the system worked on the past tick data and what broker was used for delivering it.

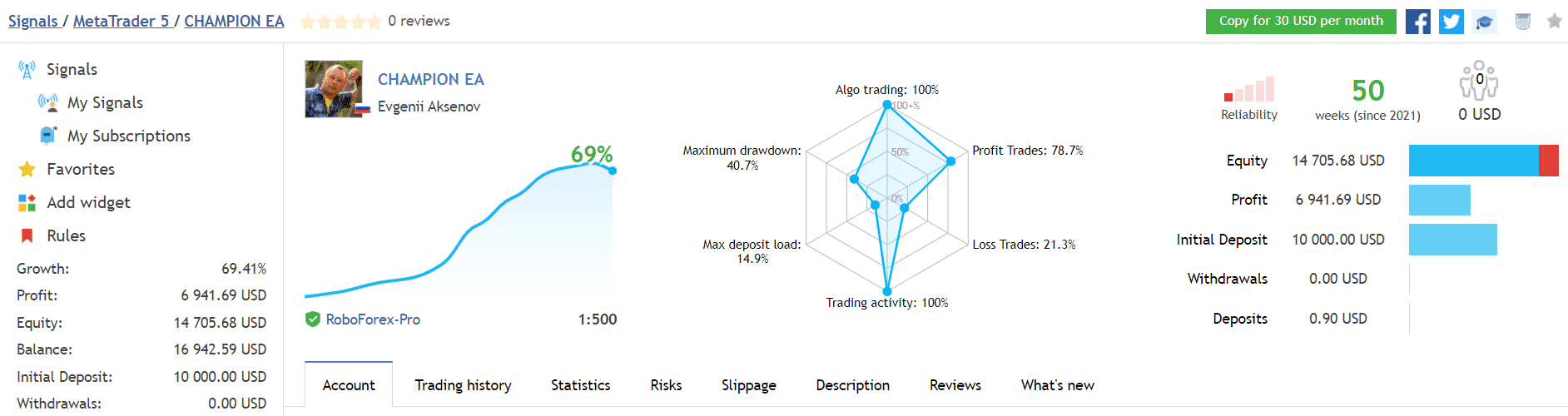

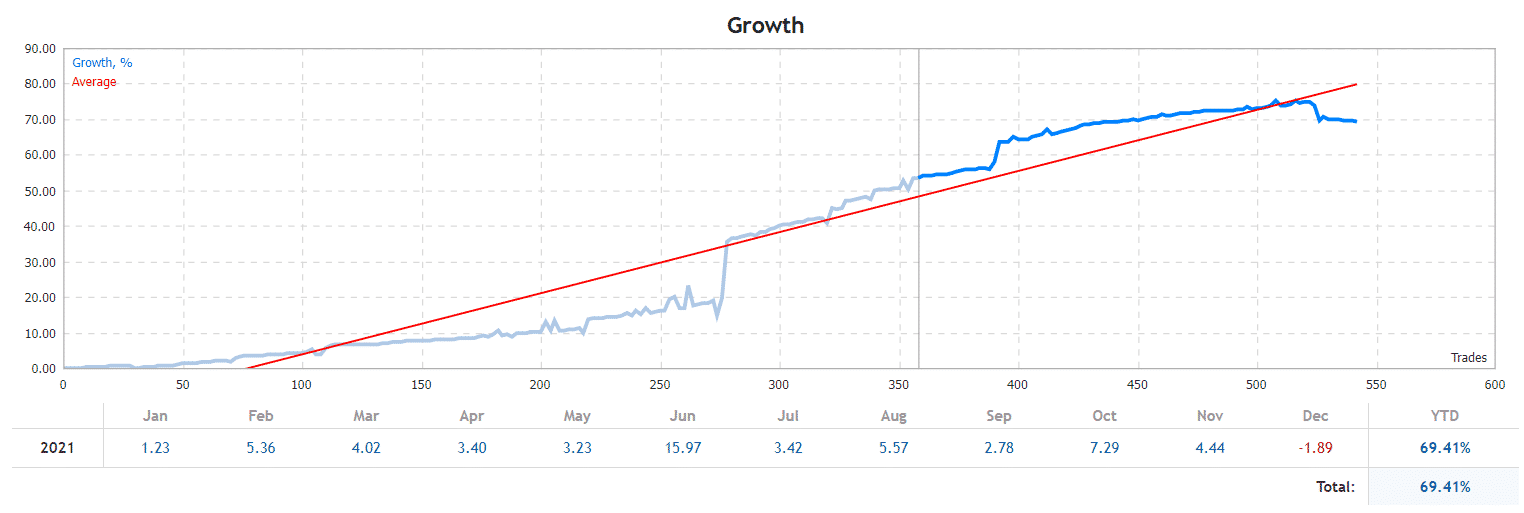

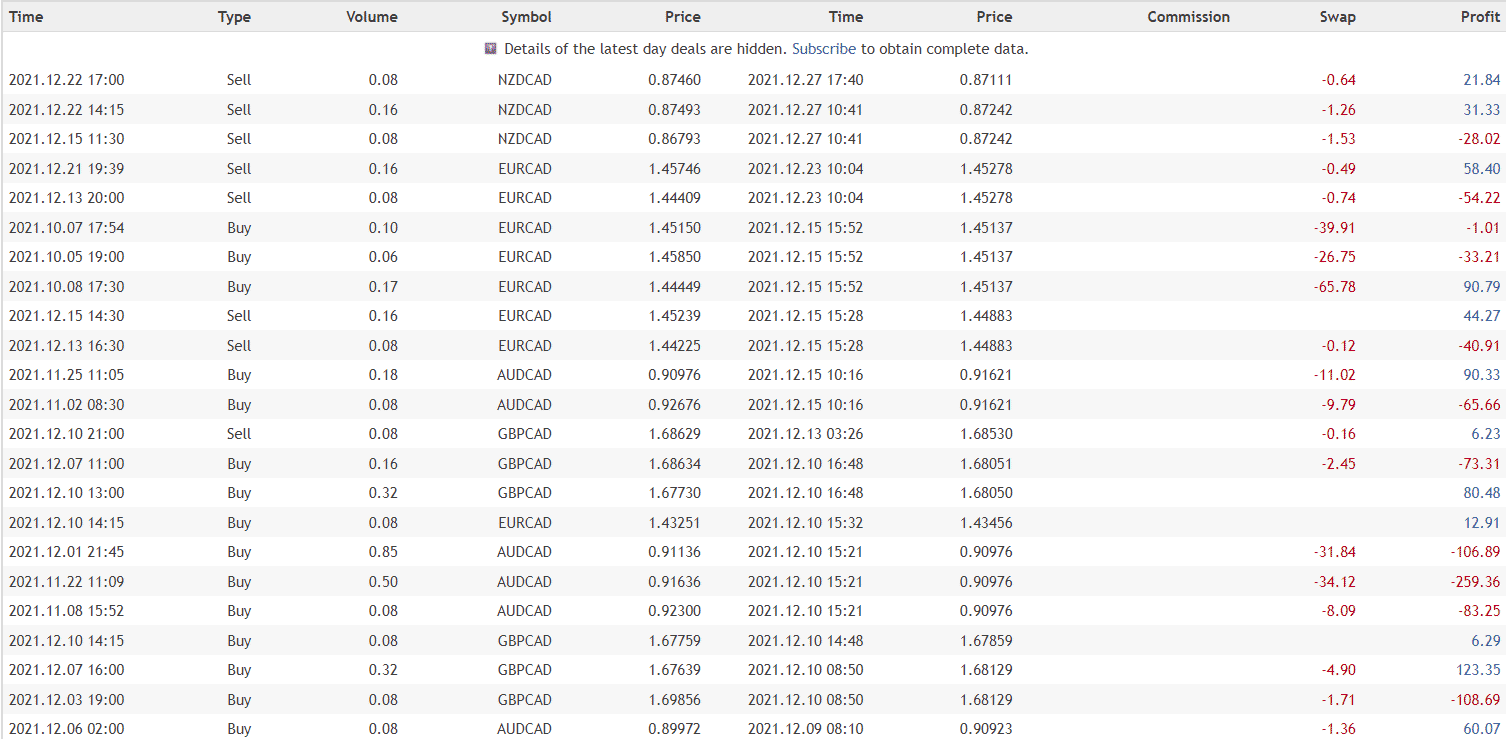

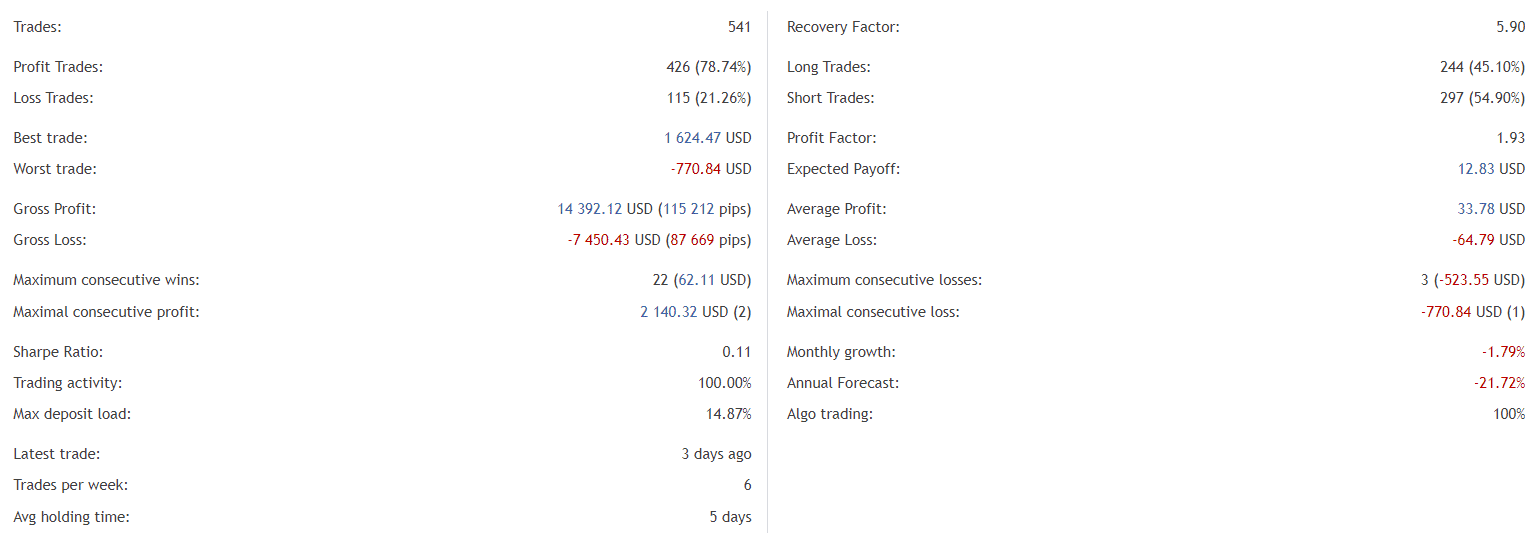

The advisor has been running a huge-deposited account of $10,000 on RoboForex with 1:500 leverage. The advisor works on a real well-deposited $10,000 account with 1:500 leverage. The maximum drawdown is 40.7%. The maximum deposit load is 14.9%. The win rate is 78.7%. The account exists for 50 weeks and signals from it are low rated.

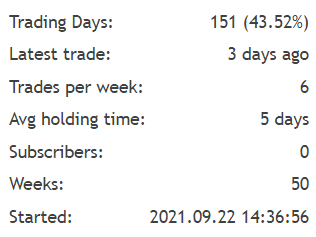

It executes 6 deals weekly. We remember it was up to 30 orders a week. An average trade length is 5 days.

The robot has lost December 2021.

As we may note, so many orders were lost. It’s suspicious.

The robot traded 541 orders. The best trade is $1624 when the worst trade is -$770. A recovery factor is 5.90 when a profit factor is 1.93. An annual profit prediction is -21.72%. An average monthly forecast is -1.79%.

AUDCAD with 243 orders is the most actively traded out.

There are so many warnings delivered. We don’t know if the system will stabilize in 2022.

Customer reviews

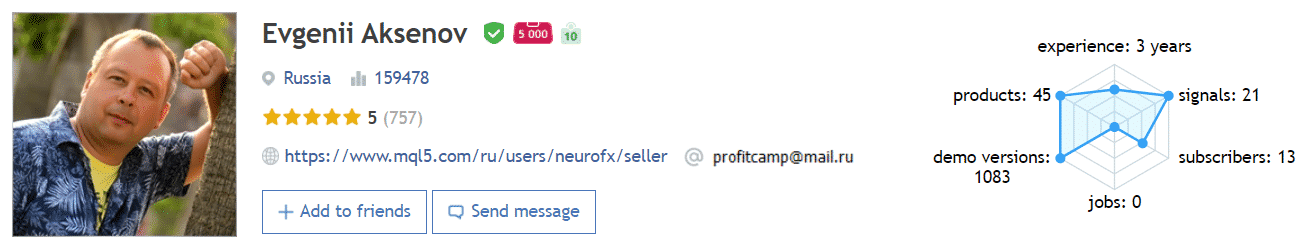

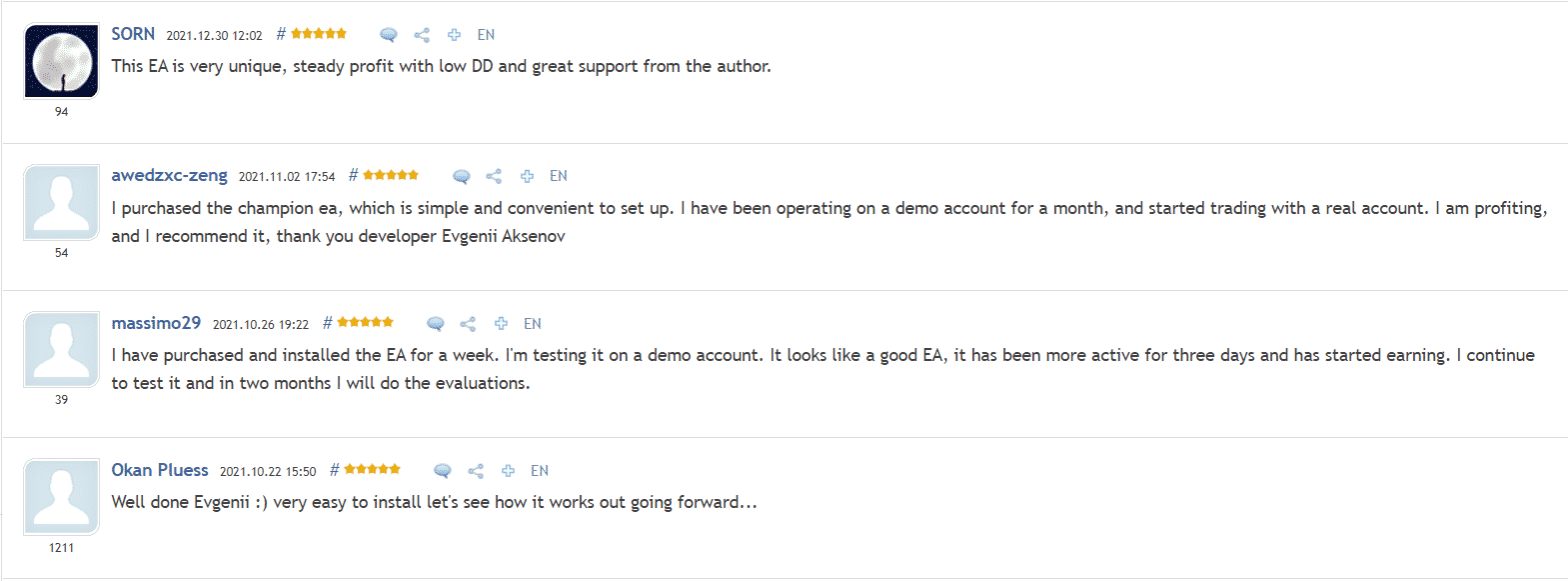

Evgenii Alseniv from Russia has a 159,478 rate and three years of experience. There’s a 5 rate based on 757 reviews.

The presentation includes only positive testimonials.