FXQuasar is another trading robot powered by Forex Store. Unlike many other systems that work with multiple currency pairs, this one is specially designed for the AUDUSD symbol. The devs say that the product will bring you profits. Let’s see if this is the case in this FxQuasar review.

The company or devs responsible for creating this trading tool are mysterious. Vendors who hide their identity and qualifications are usually incompetent. Therefore, they cannot be trusted to supply reliable products.

FXQuasar features

We have outlined the features of this robot here:

- It is fully automated.

- The program works on the MT4 and MT5 platforms.

- It has a mode that makes it compatible with NFA regulated brokers.

- Can work on any type of account.

- Offers high quality technical support 24/7.

- Provides a detailed user manual and free updates.

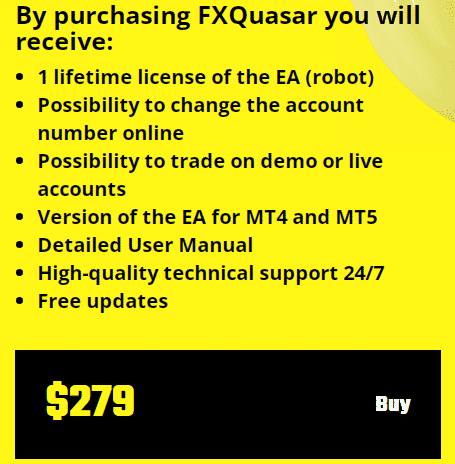

Pricing

The cost of this EA is $279. The price is a bit higher compared to the average on the market. This package includes several features like 1 lifetime license, detailed user manual user, and the possibility to trade on demo/live accounts, etc. A 30-day refund policy is on offer.

How it works

FXQuasar is a computer program designed to trade automatically for you. After buying it, you only need to attach it to the MT4 or MT5 terminal, and it can begin trading based on its built-in algorithms.

Trading strategy

FXQuasar’s trading style integrates 3 distinctive features. Firstly, the information is that the robot works with quotes and internal algorithms to assess the current market condition and past price movement. The results obtained are then used to identify trading opportunities.

With regard to the second feature, we are told that FXQuasar has 6 built-in trading sessions. Three of the sessions trade solely utilizing long positions, and the remaining ones use short positions. Every session evaluates the market uniquely. The sessions also work separately, enabling them to enter the market when needed and earn more cash.

Lastly, there is a special risk limited system, which aims at protecting traders from losses. However, it is not clear how this protection system operates.

Trading results

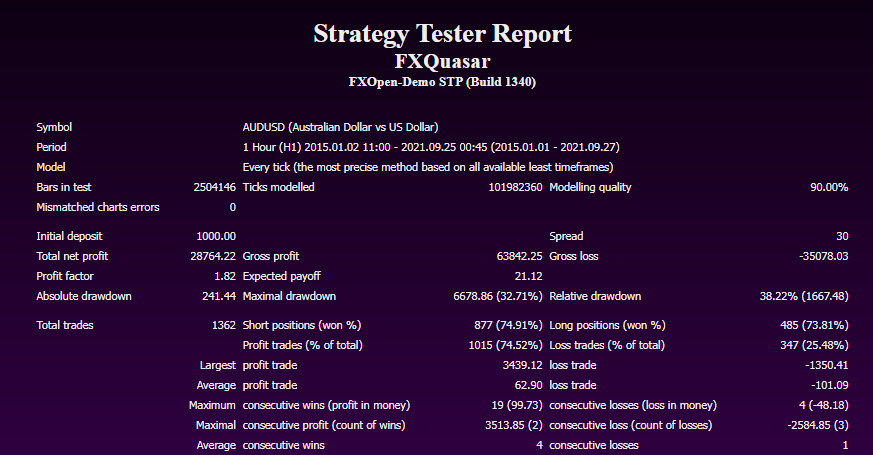

This is a backtest on AUDUSD that was done from 2015 to 2021 using 35% risk. With a capital of $1000, the system managed to earn more than $28,000 profits. This means that on average, the system generated $4700 yearly. This isn’t such a great amount. The profit factor value (1.82) also confirms that the trading algorithm is not that lucrative. The maximum drawdown was high — 32.71%. So, it is no secret that high risk trading was involved.

Clearly, the robot’s strategy lost money frequently as evidenced by the high average loss trade (-$101.09) compared to the average profit trade — $62.90

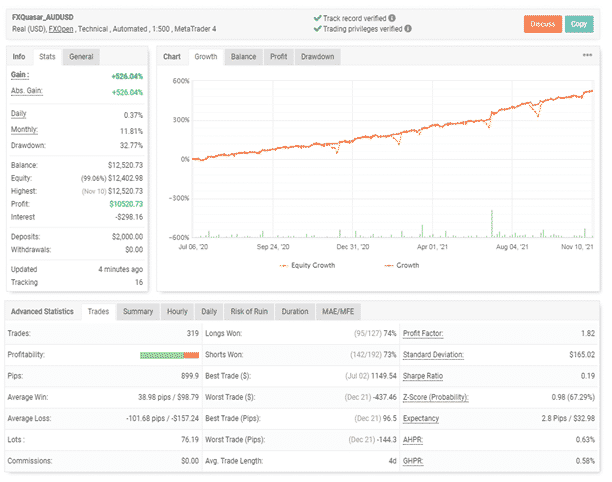

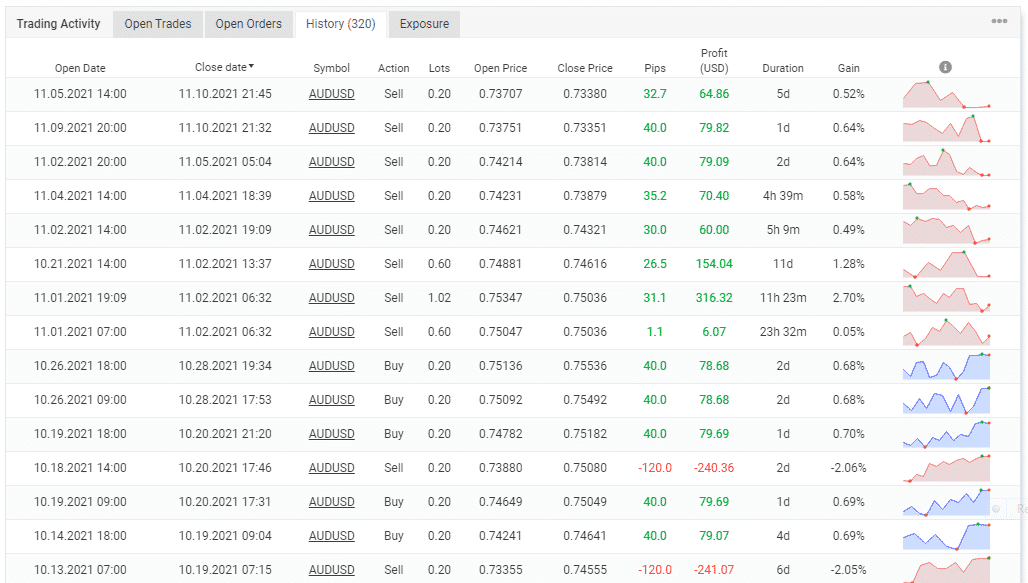

Since its opening on July 6, 2020, the EA has implemented 319 trades. Out of these, the long positions won are 74%, whereas the short ones are 73%. The resulting profit figure is $10520.73. Therefore, the deposit of $2000 has increased to reach $12520.73.

Even then, we are afraid that the robot’s trading activities are also not that productive in the live market, going by the profit factor of 1.82. For every $1 risked, only $1.82 is gained. The trading approach is risky. This is clearly demonstrated by a big drawdown of 32.77%.

The EA has a high losing streak. We know this by the high average loss of -101.68 pips. The average win is much lower by about 62 pips. The best trade added $1149.54 to the account, while the worst one caused a loss of -$437.46.

The system trades with huge lots that vary in size. Large time frames are preferred. November has recorded consistent profits.

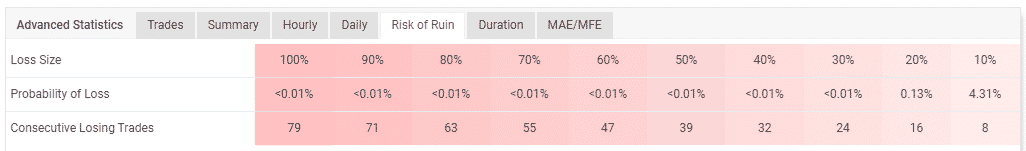

Based on the stats on the table, it is clear that the account has been weakened by the robot’s dangerous strategy. Several more losses will wipe it out.

Customer reviews

This EA lacks customer reviews on its official site and other third-party verification websites. It is possible that no one has bought it yet.