True Range Pro is available for the MT 5 platform. The robot employs an intraday scalping and grid system for trading. It has high spread protection within the algorithm and uses a bunch of indicators for market analysis. The algorithm can be tweaked to increase or decrease the monthly performance with the expense of the drawdown and risk. To take a look at the output of the product and see if traders can benefit, we will cover the robot in our article.

True Range Pro offering

The product is available on the MQL 5 website, where the developer details all the system’s important features. There are details on the features, monitoring sites, recommendations, and input parameters of the robot. Details for the Telegram channel are also available where the group is named Smartforexlab.

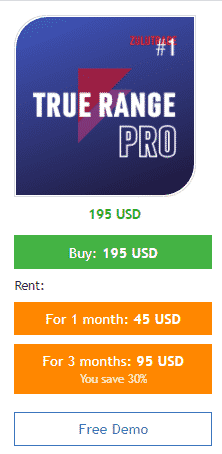

Pricing

The robot is available for an asking price of $195, and there is no money-back guarantee. Traders have the option of renting for one month at $45 and 3 months at $95.

How it works

The robot can be purchased from the MQL 5 website and then placed in the experts’ directory of MT5. Traders can then attach it to the charts to start trading. It is vital to enable expert advisors from the auto-trading button.

Trading strategy

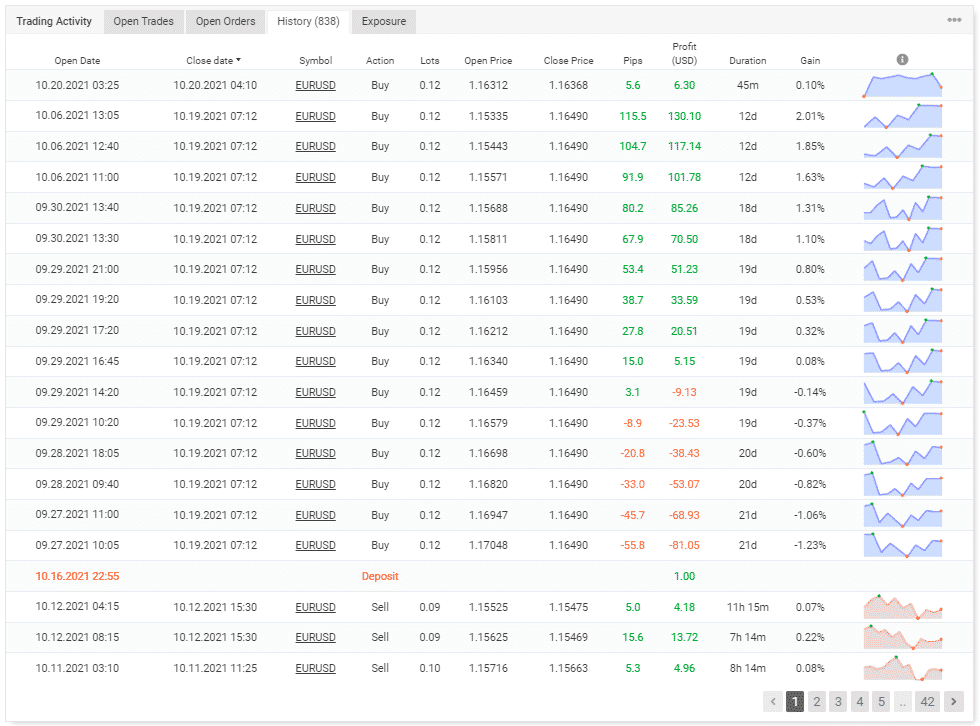

The developer states that the system uses a hard stop loss for each position. It has a night and intraday scalping approach to trades and employs a grid approach for trades. On the trading history at Myfxbook, we can see the average trade duration is one day, with positions only on EURUSD.

The robot filters out hazardous market conditions and does not trade with high spreads.

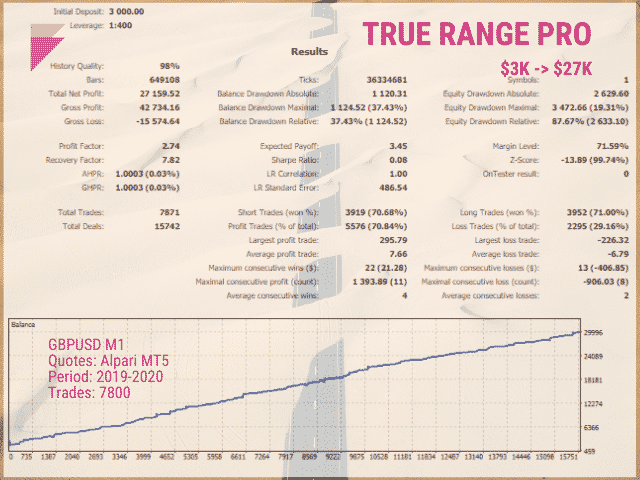

Backtesting results are available for the GBPUSD. The balance drawdown was around 37.43%, and the winning rate was 70.84%, with a profit factor of about 2.74. The tests were done on the 1 minutes chart with a starting balance of $3000. The robot tanked an average profit of $27159.52 during this period in a total of 7871 trades. The best trade was $295.79, while the worst one was -$226.32. The average profitable execution was $7.66, and the loss was -$6.79.

The stated value of drawdown is relatively high here, referring to nearly half a loss in the account balance while trading. This can impact the emotional side of an investor by a significant proportion.

Trading results

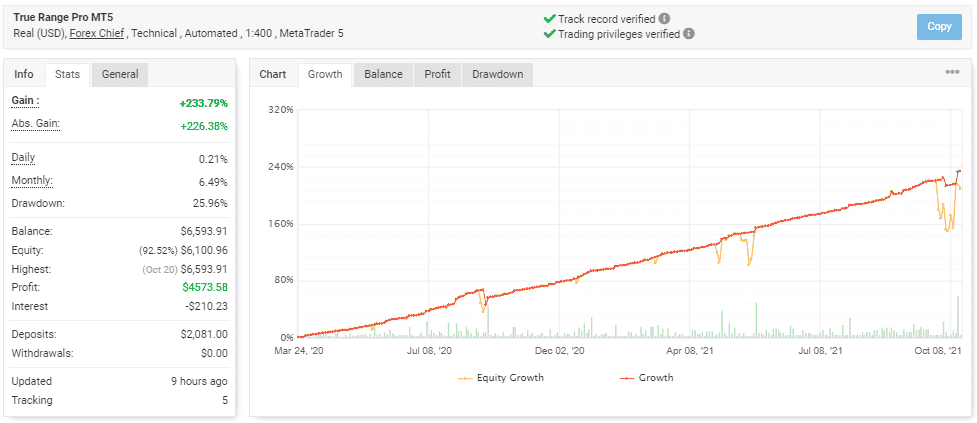

Verified trading records are available on Myfxbook that show performance from March 24, 2020, till the current date. The system made an average monthly gain of 6.49% during the period, with a drawdown of 25.96%. The stated drawdown is super high, and the risk-reward ratio is 3:1. This means that the robot has to put $3 on the line for every dollar it makes. The winning rate stood at 83%, with a profit factor of 3.01. The best trade was $130.10, while the worst was -$228.97 in a total of 235 trades.

The developer made $2081 in deposits and $0 in withdrawals.

Customer reviews

There are multiple reviews present on MQL 5 marketplace. Users state that they have been using the algorithm for a long duration, and the drawdown is stable. It is highly likely that the statements might have been bought by the provider themselves.