Arbor is an advanced trading algorithm that works on the MT4 and platforms. The algorithm uses a news filter to avoid volatile market conditions and has been backtested for more than 20 years of market data. We will discuss the potential features of the EA along with its profitability and win rate in our review. In the end, traders will be able to make their investment decision.

Arbor overview

The following are the main features of this bot:

- Easy to use

- Trades multiple currencies

- Does not use risky grid or martingale

- Includes a smart news filter

- A comprehensive FAQ section

- Available on both MT 4 and 5 platforms

The robot trades on the H1 time frame. The author comments that traders should use an ECN account with minimum leverage of 1:100. There is no information on the deposit required.

Pricing

The robot is sold for an asking price of $499. There are no renting options or money-back guarantee, unfortunately.

How it works

The algorithm scans the markets based on the set of custom indicators within its code. Traders will have to add a custom URL within the terminal properties so that The EA can access the economic calendar.

Trading strategy

The developer comments that the EA uses a set of custom indicators with a news filter to trade. Each trade comes with a stop loss and take profit. There is no involvement of grid or martingale strategies.

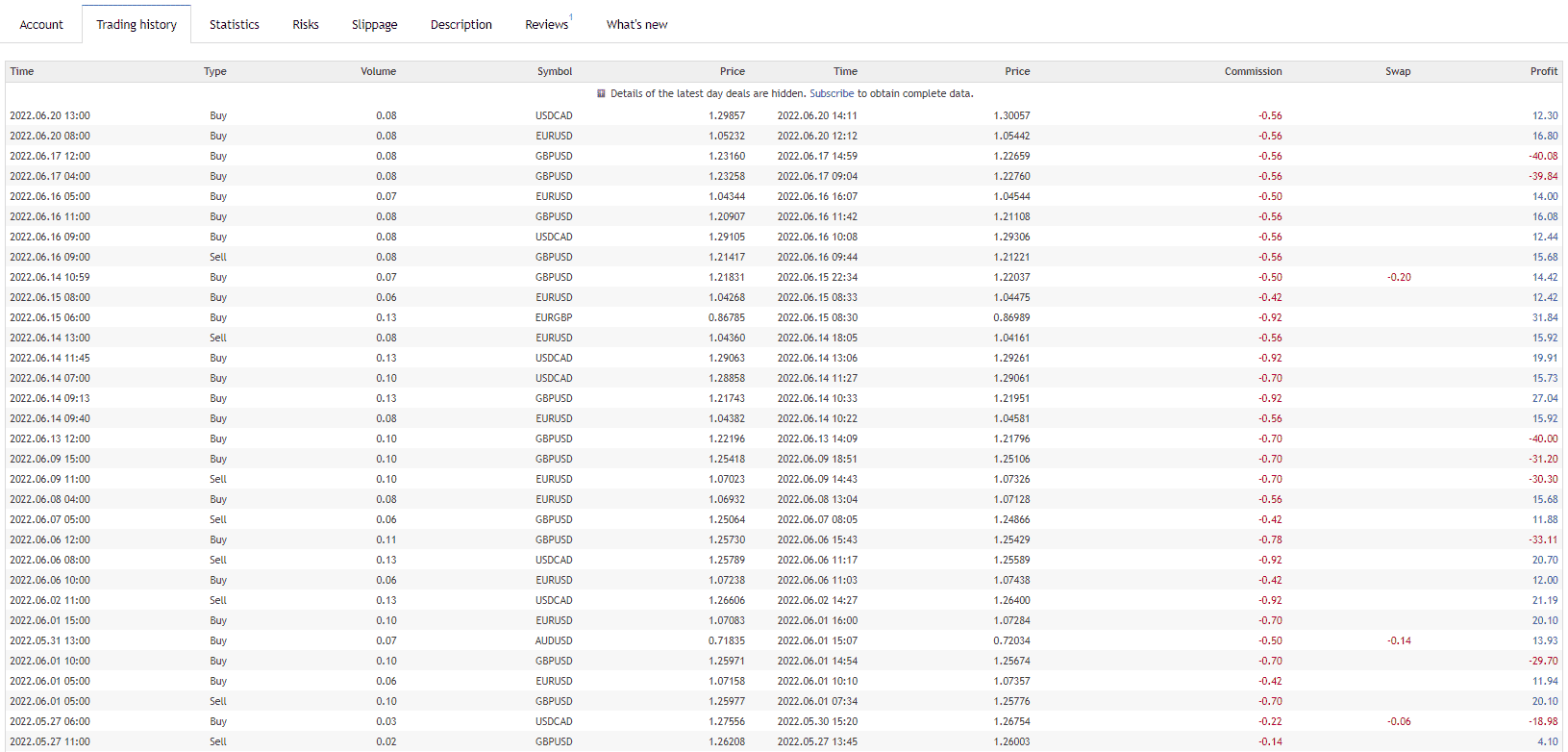

From the trading history on MQL 5, we observe that there is some strange lot increment between trades. Swaps are charged on the account, highlighting that trades are kept open overnight. The take profit can hang around 20 pips while the stop losses are broad at 60 pips.

Trading results

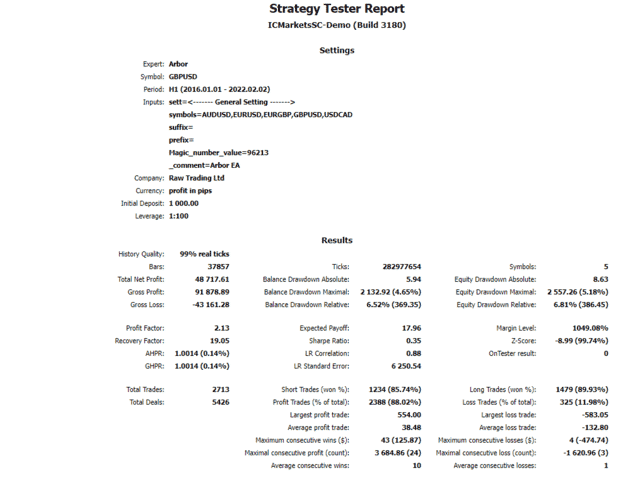

The author has provided a screenshot of backtesting records. The portfolio had an initial deposit of $1000, generating a total net profit of $48,717.61.

The algorithm performed 2713, managing a win rate of 88.02%. The account balance drawdown stood at 4.65%, with a profit factor of 2.13.

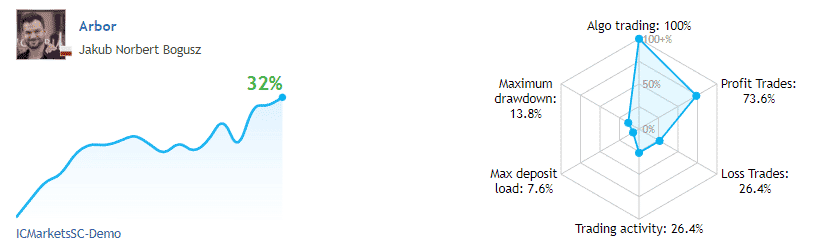

The seller provides live records of the EA on MQL 5. These correspond to the trade executed on a demo account with unknown leverage. These stats cover the performance from Feb 04, 2022, to date.

The monthly growth rate is 6.1%, with a drawdown value of 13.8%. Deposits are written as 1000 USD, with profit marked as 316 USD.

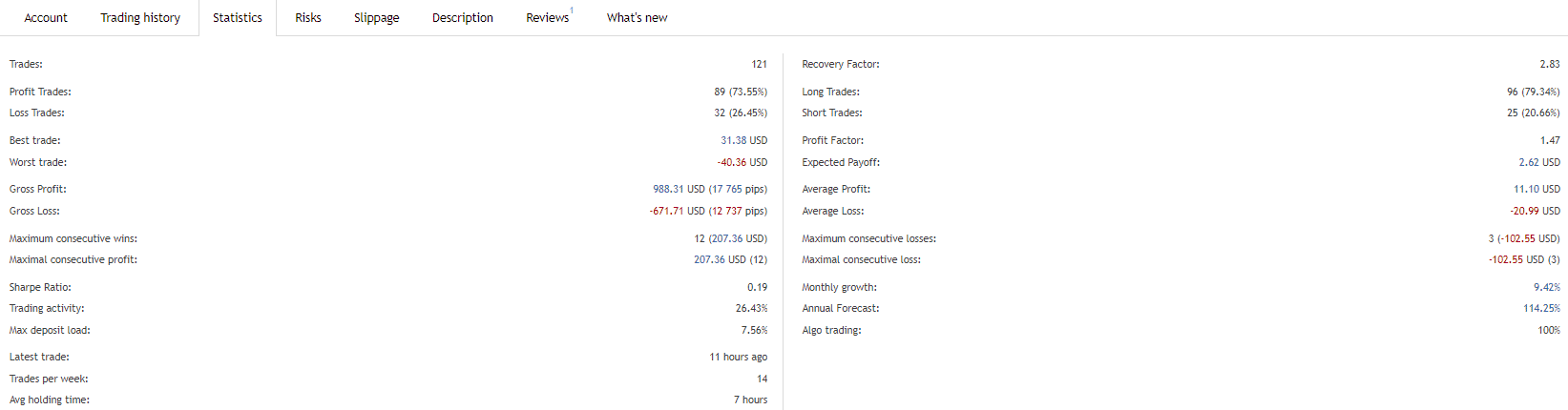

The algorithm made 121 trades, of which 32 resulted in a loss. The profit factor shown in these results was 1.47, with an average trade length of 7 hours.

These trading results are the only source of performance data. No reputable third-party websites, like Myfxbook, etc., were able to confirm them.

Customer reviews

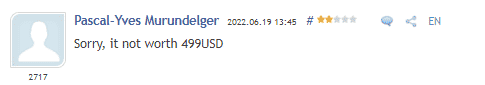

There are 29 customer reviews on MQL 5 marketplace, giving the EA a total rating of 4.39. A trader comments that the algorithm is not worth its high asking price.

Another trader states that the developer is keen to provide support and that the EA has good potential.