DDMarkets trades on forex and cryptocurrencies and trading using day and swing styles. The company uses technical and fundamental analysis to provide executions. They claim to maintain good risk management by offering a fixed stop loss and take profit. Let us see what kind of output we can receive after following the signals.

The company doesn’t provide any information on the trading experience of the traders who do the analysis. We are left stranded while trying to find their location and other basic knowledge about DDMarkets.

To choose the best signal service, traders must consider if the vendors are using a solid trading methodology with a good stop loss and take profit. The DDMarkets company claims it uses a clean exit and entry for all trades, which caught our attention, and we decided to review the service.

DDMarkets features

DDMarkets has the following features:

- It trades forex and cryptocurrencies

- It provides multiple packages for different durations

- It provides both swing and day trades

- The developers document their trade alerts since 2014

Pricing

There are multiple plans that traders can choose according to their liking. All the packages differ in terms of duration and service. The 14-day plan for global trade alerts, which includes all the positions, costs $59.90. For one month, the same service will require $87.40.

How it works

The company uses the following approach for its signals:

- The trading positions are sent to the email id of the trader

- Traders copy them to their trading portfolios and include the stop loss and take profit

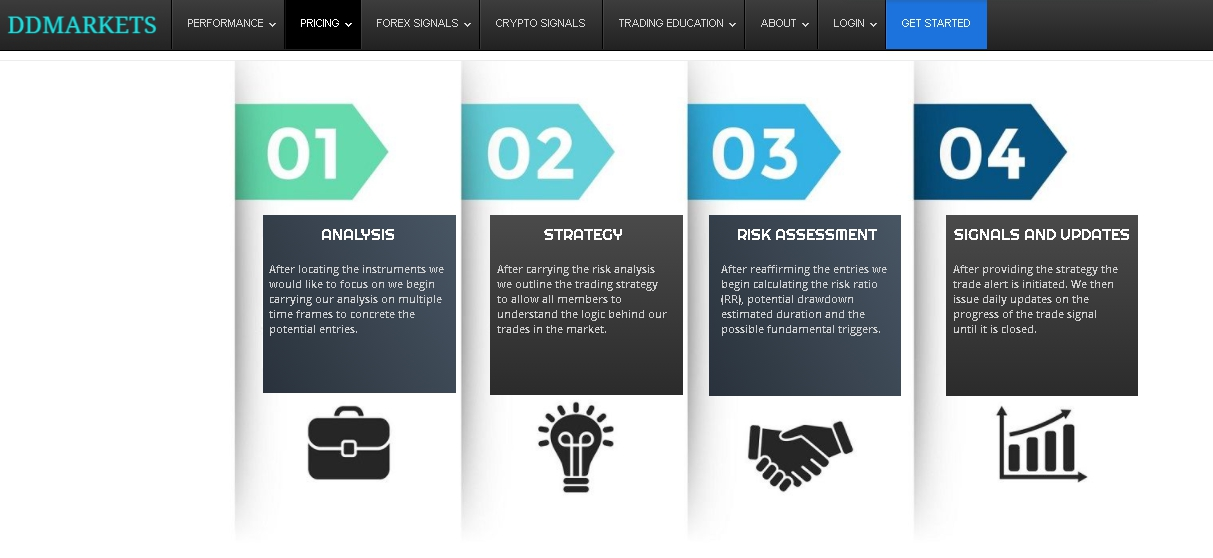

The company tries to showcase professionalism by providing a detailed map they use to take positions in the market. First, they carry out analysis on multiple time frames and find out the entry. The idea is then presented to members so they can understand the logic. In the third step, the signal providers determine the risk, reward, and the associated drawdown that may incur. The trade is then sent out to traders and is monitored until closed.

Trading strategy

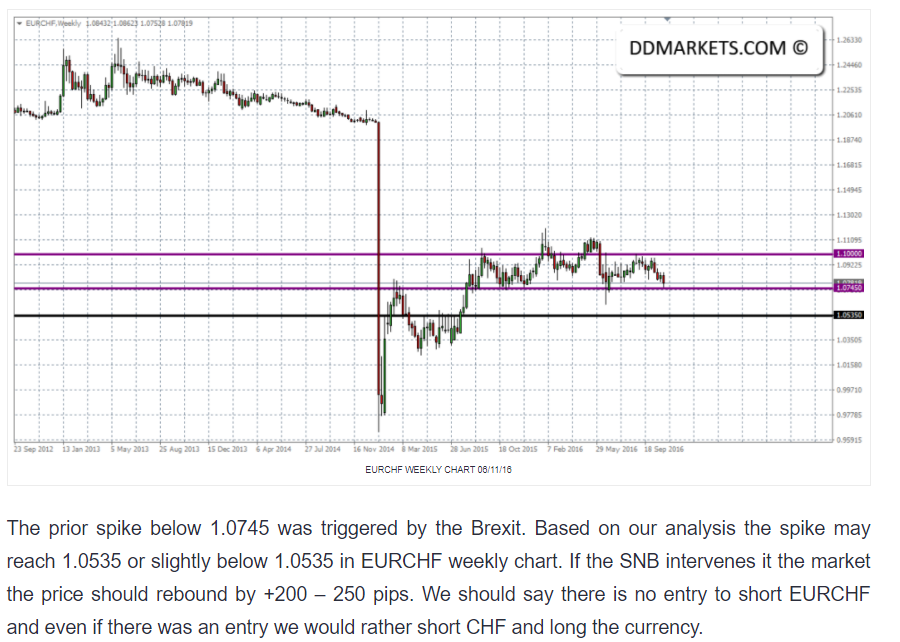

The signal providers state that they use both swing and day trading. The analysis is made by using the price action and fundamentals. Each position comes with a detailed idea that traders can read. From their example, we can see that they employ limit orders to enter the market and plot respective support and resistance lines on the chart for the technical side. Depending on the market, the trades can include big or small stop loss. The company claims that they aim for a risk-reward ratio of 1:3.

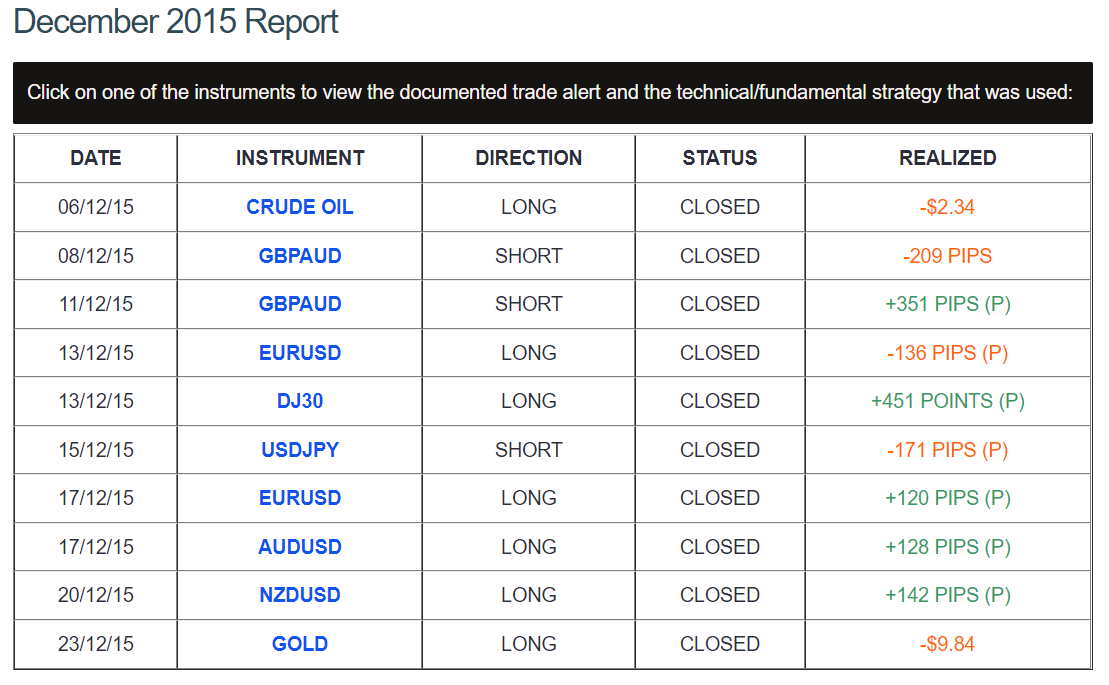

Trading results

The company doesn’t track its performance through verified websites such as Myfxbook, which raises many red flags. This type of approach shows that they are not comfortable sharing their true output because it may be poor. They are only tracking the positions through their website. Such kinds of results can easily be manipulated to attract customers. We can not get an idea of the monthly gains and the drawdown this way.

Customer reviews

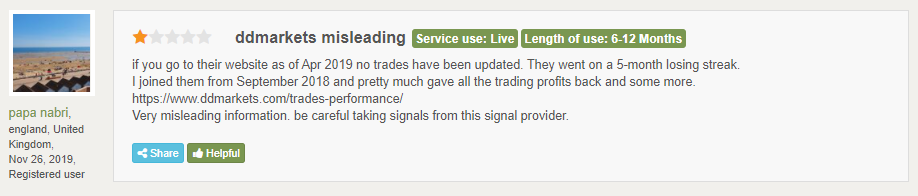

Customer reviews are available on the Forex Peace Army for DDMarkets, which have a rating of 2.538 for a total of 4 feedbacks. Customers state that the company is not tracking their results properly and have been on a losing streak for a long duration.

Another customer states that they are constantly shifting their stop loss from one point to another. He says that the initial risk-reward ratio on trades is non-existent as the trades are always manipulated. The customer support is also poor.